So you e-filed your HVUT 2290, but realize you made an error on your VIN, yet the IRS accepted it anyway. Don’t’ panic. The remedy is to file a VIN correction. By Filing a VIN correction, you’d only have to report the discrepancy of the previous tax return along with the required change on the alphanumeric charters of the Vehicle Identification Number. Continue reading

Greetings! You have landed at the right place in case you have been wondering why everyone’s talking laurels about e-filing over paper for long now. Obviously, you go green immediately, without wasting paper products of our beloved little left trees. The ability to file your tax returns round the clock throughout the week right at your desk at home makes life very comfortable and easy. The speed of the entire tax return process dramatically increases with e-filing over paper due to advanced INTERNET capabilities thus saving your hard earned money and energy worked out on postage/fax/courier/delivery charges, which of course can be used over a million other valuables.

Greetings! You have landed at the right place in case you have been wondering why everyone’s talking laurels about e-filing over paper for long now. Obviously, you go green immediately, without wasting paper products of our beloved little left trees. The ability to file your tax returns round the clock throughout the week right at your desk at home makes life very comfortable and easy. The speed of the entire tax return process dramatically increases with e-filing over paper due to advanced INTERNET capabilities thus saving your hard earned money and energy worked out on postage/fax/courier/delivery charges, which of course can be used over a million other valuables.  Are you still in the Stone Age by paper filing your Excise Tax returns? Guess what, more than 70 percent of the taxpayers file their taxes electronically. The IRS has processed over a billion HVUT returns safely and securely since the past decade, the Official beginning of E-filing ERA. Very few still stick with paper filing

Are you still in the Stone Age by paper filing your Excise Tax returns? Guess what, more than 70 percent of the taxpayers file their taxes electronically. The IRS has processed over a billion HVUT returns safely and securely since the past decade, the Official beginning of E-filing ERA. Very few still stick with paper filing  Hello Truckers, we’re back with yet another article to remind you about the near term HVUT deadline that waits by the end of this month Sep 30 for vehicles that are used on the road since Aug 2017. Form 2290 is generally due by June and its payable until the end of August. However, this law is only applicable for general annual renewals. Else, Form 2290 must be filed by the last day of the month following its month of its first use. On that basis Sep 30, would be the deadline to E-File Form 2290 for the vehicles which has been operated over public highway since Aug 2017.

Hello Truckers, we’re back with yet another article to remind you about the near term HVUT deadline that waits by the end of this month Sep 30 for vehicles that are used on the road since Aug 2017. Form 2290 is generally due by June and its payable until the end of August. However, this law is only applicable for general annual renewals. Else, Form 2290 must be filed by the last day of the month following its month of its first use. On that basis Sep 30, would be the deadline to E-File Form 2290 for the vehicles which has been operated over public highway since Aug 2017.

Though it’s not August now, it doesn’t mean that you can’t renew your Form 2290 for the Period beginning July 1, 2017 through June 30, 2018. You may E-file them now via

Though it’s not August now, it doesn’t mean that you can’t renew your Form 2290 for the Period beginning July 1, 2017 through June 30, 2018. You may E-file them now via  If this rings a bell in your mind, probably you missed your HVUT Form Renewal. The Deadline to E-Renew Form 2290 for the period beginning July 1, 2017 through June 2018 was Aug 31, 2017. However, we realize that everyone can’t really afford time to spare towards E-filing Form 2290 during this time due to their busy work schedule. Hence, it doesn’t mean that it’s the end of the road. You may still renew your Form 2290’s now for the Period beginning July 2017 through June 2018 right now to stay away from incurring more penalties towards late filing and late payment of HVUT taxes.

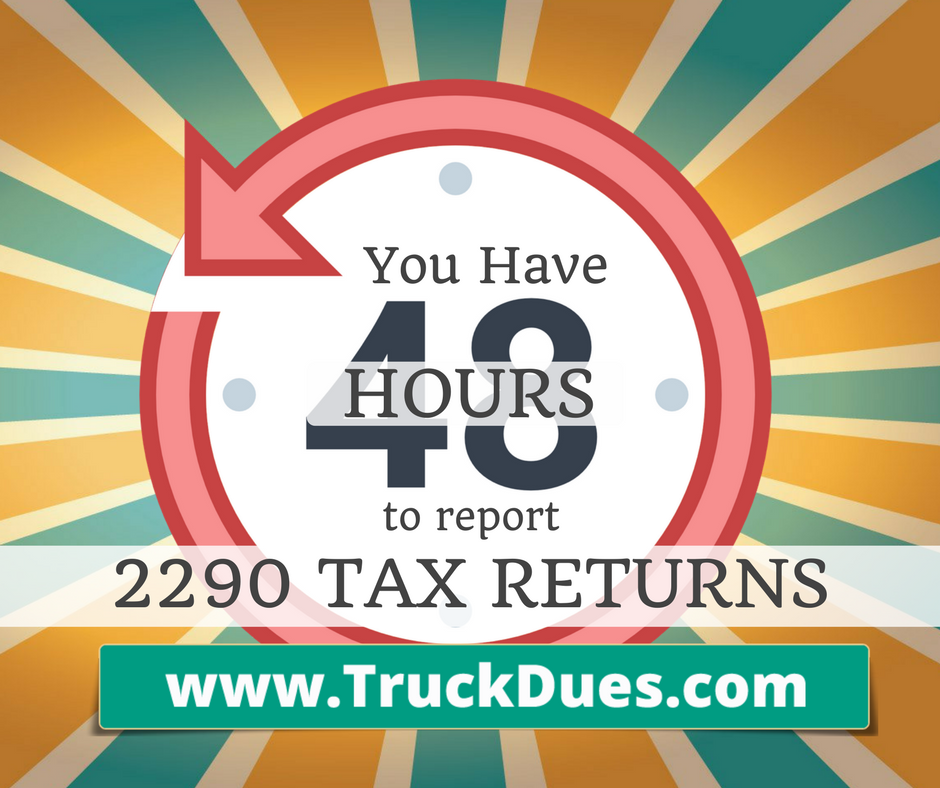

If this rings a bell in your mind, probably you missed your HVUT Form Renewal. The Deadline to E-Renew Form 2290 for the period beginning July 1, 2017 through June 2018 was Aug 31, 2017. However, we realize that everyone can’t really afford time to spare towards E-filing Form 2290 during this time due to their busy work schedule. Hence, it doesn’t mean that it’s the end of the road. You may still renew your Form 2290’s now for the Period beginning July 2017 through June 2018 right now to stay away from incurring more penalties towards late filing and late payment of HVUT taxes.  Truckers, we are now just at a couple of days away from the HVUT tax deadline. Just 48 hours left until renewing your Form 2290 for the period beginning July 1, 2017 through June 30, 2018. All the last moment filers are online now to E-renew them Form 2290’s. In case you haven’t e-filed your Form 2290 yet, Log on to www.truckdues.com and e-file your Form 2290’s ASAP and receive the IRS watermarked copy of schedule 1 in your e-mail instantly.

Truckers, we are now just at a couple of days away from the HVUT tax deadline. Just 48 hours left until renewing your Form 2290 for the period beginning July 1, 2017 through June 30, 2018. All the last moment filers are online now to E-renew them Form 2290’s. In case you haven’t e-filed your Form 2290 yet, Log on to www.truckdues.com and e-file your Form 2290’s ASAP and receive the IRS watermarked copy of schedule 1 in your e-mail instantly.  Truckers, it’s now high time to E-file your Form 2290 for the period beginning July 1, 2017 through June 30, 2018. Several thousands of tax payers, who procrastinated on their HVUT deadline, would be braced now to E-file their Form 2290 at the very last moment. Things done at the last moment creates space for human errors. So, after you read this article you must be aware that you’re almost near the deadline as its due in just 4 days and we don’t want you to prolong it anymore.

Truckers, it’s now high time to E-file your Form 2290 for the period beginning July 1, 2017 through June 30, 2018. Several thousands of tax payers, who procrastinated on their HVUT deadline, would be braced now to E-file their Form 2290 at the very last moment. Things done at the last moment creates space for human errors. So, after you read this article you must be aware that you’re almost near the deadline as its due in just 4 days and we don’t want you to prolong it anymore.  Time waits for none, it really matters how we efficiently utilize the time in getting our works done. The same saying applies when it comes to your HVUT Form 2290 deadline, The IRS let you e-filing your Form 2290 for the period beginning July 1, 2017 through June 30, 2018 since the beginning of July 2017. They gave you 90 days before you can e-renew your Form 2290, by far 55 days has passed by, hence we got very less time left behind to meet the deadline.

Time waits for none, it really matters how we efficiently utilize the time in getting our works done. The same saying applies when it comes to your HVUT Form 2290 deadline, The IRS let you e-filing your Form 2290 for the period beginning July 1, 2017 through June 30, 2018 since the beginning of July 2017. They gave you 90 days before you can e-renew your Form 2290, by far 55 days has passed by, hence we got very less time left behind to meet the deadline.