Dear truckers! TruckDues.com wishes you a Happy Christmas 2022! And a wonderful new year, 2023! We wish the magic of Christmas fills every corner of your heart and home with joy, now and always. Also, we thank you for your continuous support and for making this year fantastic. As we enter the new year, let this year be fantastic, and let all our dreams come true!

Tag Archives: Truckers

We send our Thanksgiving wishes to all our users and truckers!

TruckDues.com wishes and thanks all our customers, users, and trucking taxpayers for a very happy thanksgiving 2022! We are always thankful for your constant support in making us one of the top form 2290 online e-filing service providers in the US. We will work towards making online form 2290 e-filing much simpler, more accessible, and more robust.

Form 2290 pre-filing is going to end soon at TruckDues.com. Hurry up and pre-file form 2290 today!

Pre-filing form 2290 is actively happening at Truckdues.com, and many truckers have already completed their form 2290 online pre-filing with us. Form 2290 pre-filing helps the truckers to finish their tax reports beforehand and efile them at TruckDues.com so they can be free when the tax period starts in July.

The next tax season is coming soon!

Form 2290 pre-filing gives you a head-start to e-file your form 2290 tax reports ahead of the tax season. IRS only accepts form 2290 for the tax year at the beginning of the tax season in July. Therefore, this year’s tax season starts around the first week of July 2022 and ends on 30 June 2023. All the truckers and truck taxpayers have time till 31 August 2022 to report their truck taxes using form 2290 and get the schedule 1 copy for their heavy vehicles or trucks. IRS will get crowded at the beginning of July as it is the start of the tax season and many truckers file their form 2290 tax reports. This might delay your form 2290 filing process, and your schedule 1 copy might fall behind the deadline.

E-file Form 2290 online at TruckDues.com this tax period!

TruckDues.com is an IRS-approved modernized online form 2290 e-filing service provider proudly serving the trucking community of the United States. Since trucking is one of the colossal businesses in the US, we provide the best form 2290 electronic filing support for all truckers and all types of trucking businesses. From owner-operators to trucking conglomerates, Truckdues.com provides the best form 2290 e-filing services in the market with the help of innovation and technology. Truckdues.com offers a convenient online solution that stands out from the conventional paper filing methods.

IRS made it mandatory for the truckers to e-file form 2290 truck taxes if they have 25 or more vehicles in their fleet. They even encourage the owner-operators with a single heavy vehicle to e-file form 2290 online because e-filing is the effective way to report the form 2290 truck taxes to the IRS. Also, it is easy for the IRS to process your form 2290 tax reports and send the schedule 1 copy directly to the email as every process is automatic, robust, and accurate. Apart from these, there are a lot of advantages to e-filing form 2290 online at TruckDues.com. Continue reading

Continue reading

Form 2290 HVUT tax period for this year is just a few days away!

Hello, Truckers! Again, the tax season is upon us for the year, and we all want to smoothly file our form 2290 truck taxes to the IRS, pay the tax dues, and get the IRS-approved schedule 1 copy to continue the trucking operations.

Form 2290 HVUT

IRS charges the Highway Heavy Vehicle Use Tax for all heavy vehicles and trucks through form 2290 every year to use the public highways of the United States. Therefore, truckers and trucking taxpayers like truck owners, owner-operators, and business owners should file their form 2290 truck taxes to the IRS in advance for the year’s tax period.

The tax period for this year starts on July 1, 2022

Generally, the tax period starts around the first week of July and lasts till the end of the next June. So, the tax period for this year is from July 1, 2022, to June 30, 2023. Therefore, truckers should report their form 2290 tax reports from July 1 and get their schedule 1 copy soon. The deadline to file form 2290 truck taxes for the upcoming tax period is August 31, 2022. You should stay alert and report your truck taxes within the deadline. Else, IRS will charge hefty penalties and late charges on your tax dues. On the other hand, operating your trucks or heavy vehicles on public highways is impossible without a valid schedule 1 copy. Continue reading

Continue reading

Form 2290 Pre-filing is open at TruckDues.com! Pre-file now and enjoy the benefits!

Form 2290 is actively going on at TruckDues.com. Truckers and truck taxpayers are pre-filing form 2290 HVUT ahead of the upcoming tax season, TY 2022-2023, to stay ahead of the crowds for the new tax season. IRS only accepts the form 2290 truck taxes during the tax season in July 2022, but we offer you this pre-filing form 2290 scheme to conveniently prepare your truck tax returns and file them ahead of the tax season. Form 2290 Pre-filing allows you to take your time to file your tax returns months ahead of the actual tax season. So, you get ample time to prepare your form 2290 truck tax returns without any last-minute tension and file it with us. We will then transmit it to the IRS once they start accepting form 2290 for the tax season, and you will get the schedule 1 copy at the earliest.

TruckDues team wishes everyone a Happy Friendship Day

A friend is the one who walks in when the rest of the world walks out.” They,

F-ights for you

R-espects you

I-nclude you

E-ncourage you

N-eed you

D-eserves you

S-tands by you

Even love can emerge at first sight but friendship takes years to build, A relationship that never breaks and stands by like a shadow of you. A friend is someone who understands your past, believes in your future, and accepts you just the way you are. To all our dear truckers on the road, we extend our warm Friendship day wishes. You need your friends especially at this time of pandemic to make your life better and shoulder to rely on. The word Believe itself hides under the wings of friendship the strongest bond that has ever been created.

Continue readingIt’s a Pandemic, Be Safe and Work Smart!

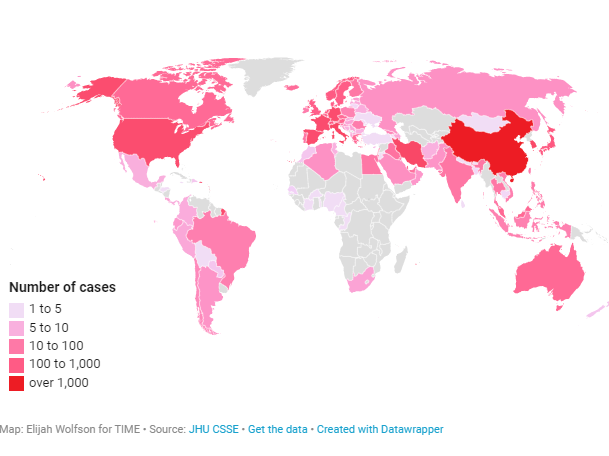

Lockdown around the world, businesses shut down and people are isolated inside their homes. It’s a major setback to the world economy, stock markets plunging as never seen before in decades. Corona has brought the world to almost a standstill situation now. Governments locking down their borders and working day and night to stop this pandemic. Its time for us to be responsible and stay cautious.

As per the CDC (Centers for Disease Control and Prevention) report the total number of cases reported to date is 213,144 and increasing. Out of which 4,513 deaths have declared. Our president in his recent press meet has confirmed that a greater number of people will get affected and the death tolls might increase drastically. If you are at your home please stay indoors and avoid contacting people as much as you can as they might be passive carriers of the disease.

We’re not trying to market our product but its better to do stay indoors and file your Form 2290s as this will stop you from going outdoors and risking yourself. Go digital and try to make the most of the online services to get all your works done. By e-filing your Form 2290’s you save Time, money and probably even your health. As online services are a healthy alternative at this moment. If you’re not familiar with how to file your taxes online, we are here to assist you. We are open for work through remote access for your e-filing need through calls, chats, and email.

E-filing just takes around 5 minutes of your time to prepare your tax return and within minutes you would receive the schedule-1 copy in your email. The taxes can also be paid by opting for an automatic debit from your checking or savings account so that you may not necessarily go out to mail a check. Also, we’re economical when it comes to pricing as we charge only $7.99 per vehicle filing. We are at your disposal, Kindly call us at 347-151-2290 or just drop us an email to support@truckdues.com

Stay safe and work safe!

Protect Yourself and Others from the novel Coronavirus disease (COVID-19)

It is with great sadness that the world is facing a “To be” pandemic disease the “CORONA VIRUS” (COVID-19) being reported from more than 113 countries apart from china from where its outburst declared first in the world with effecting more than 80,000 people and 43,500 outside the nation so far and increasing. This is the time to be cautious and not to get prone to it. This is a concern, especially towards you dear truckers!

IRS stops accepting HVUT payments using credit or debit cards until further notice.

Hello dear truckers! Here we meet you again with yet another update regarding your from 2290’s. Recently the IRS published a notification officially stating that they have stopped accepting payments using credit or debit cards until further notification. Paying using credit or debit card was the most opted way of payment mode for most of us know what to do in this case? Well, we do have 3 more options and let’s see what can be done.

Continue reading