We want to take this moment to thank you all for making the tax filing period of this season a monumental success. We are delighted to announce that we recorded the highest Form 2290 tax e-filing for TruckDues.com in this period. Again, we thank you for your contribution and for choosing us as your constant Form 2290 e-filing service partner. Also, many new truckers and trucking taxpayers have joined our family and successfully e-filed Form 2290 tax reports for this season. We sincerely hope you had an amazing experience on our platform and will continue your Form 2290 tax filing journey.

Category Archives: Form 8849 Schedule 6

This holiday season is upon us! Report your taxes early and enjoy your holidays!

Dear truckers! TruckDues.com wishes you a Happy Christmas 2022! And a wonderful new year, 2023! We wish the magic of Christmas fills every corner of your heart and home with joy, now and always. Also, we thank you for your continuous support and for making this year fantastic. As we enter the new year, let this year be fantastic, and let all our dreams come true!

Affordable form 2290 online e-filing services at TruckDues.com.

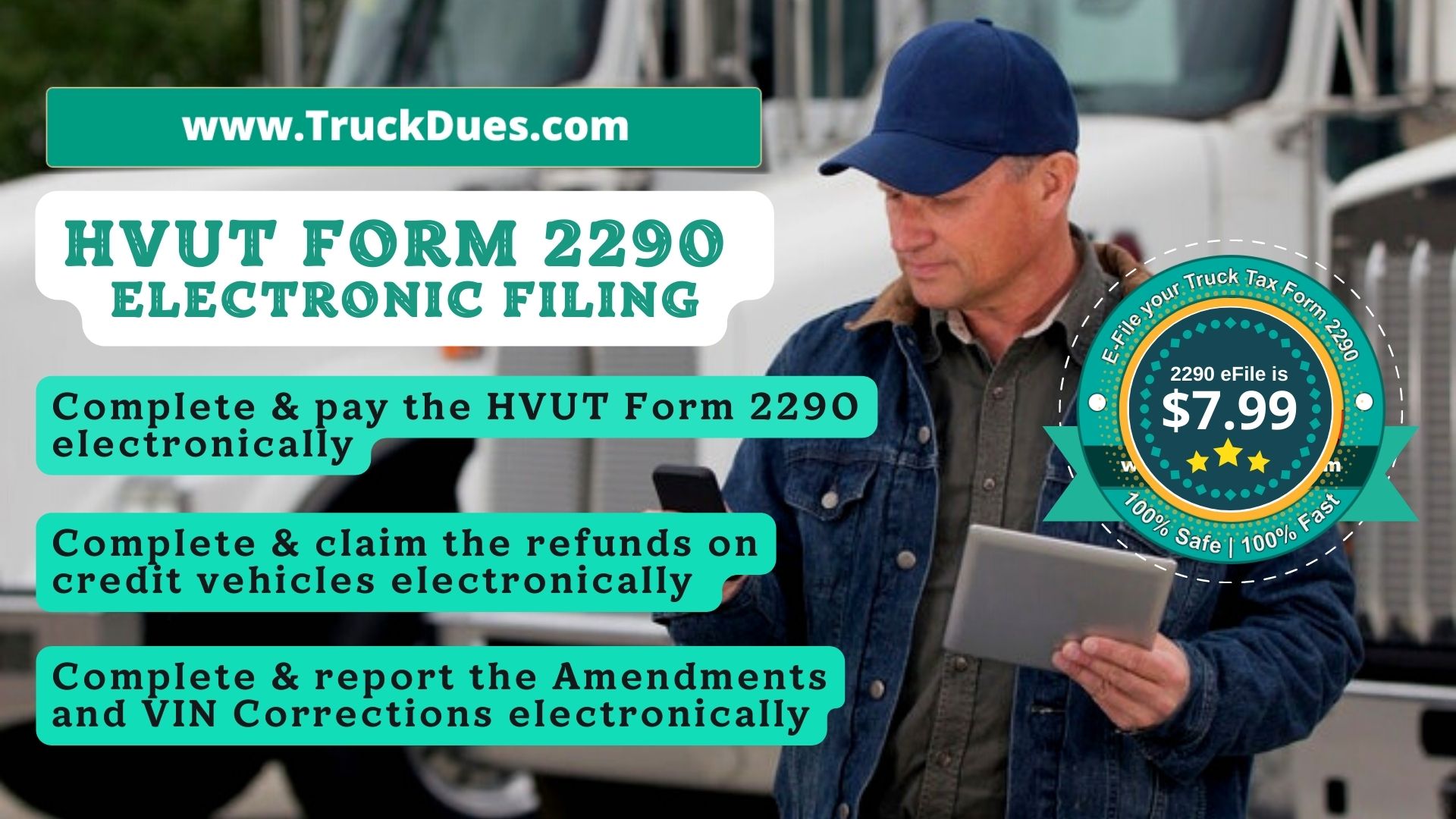

Hello, truckers! Truckdues.com takes pride in serving you with form 2290 online e-filing solutions and making things easy for you to report and pay form 2290 truck taxes to the IRS. Truckers, owner-operators, trucking conglomerates, CPAs, and other truck taxpayers benefit significantly from our services. The first and foremost thing they find most helpful is our pricing structures. We provide the most pocket-friendly form 2290 HVUT online e-filing services than any other service provider in the market. From single-vehicle taxpayers to bulk taxpayers, our platform provides the best form 2290 online e-filing solutions at highly comfortable rates. We provide free VIN correction services for our customers. TruckDues.com also offers form 2290 amendments e-filing, form 8849 schedule 6 truck tax refund claims at the lowest prices.

When can you e-file form 2290 at TruckDues.com?

Dear truckers! Truckdues.com has been serving you for decades, aiding you to easily e-file form 2290 HVUT online to the IRS. We keep innovating new technology to increase features and facilitate your form 2290 e-filing more effectively. TruckDues.com has attractive features that help you to e-file form 2290 online directly to the IRS efficiently. You will save a lot of money and time when you e-file your truck tax returns at TruckDues.com. Our platform offers the new era of form 2290 reporting, where all truckers can report form 2290 electronically without hassle.

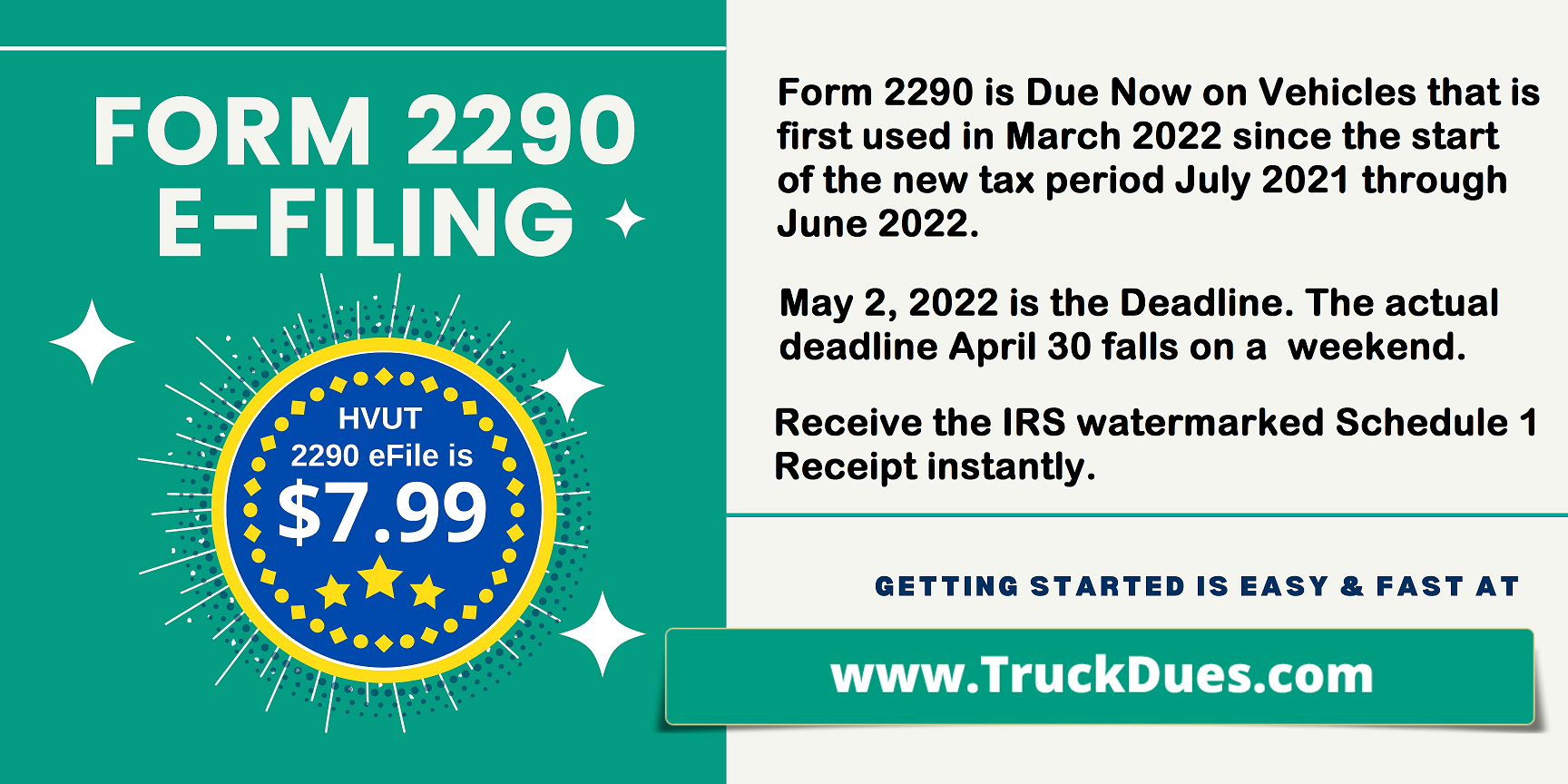

Form 2290 Partial Period Tax on Heavy Highway Vehicles used in March 2022 is Due Soon!

The heavy highway vehicle use tax, HVUT form 2290, is due for the trucks that are first used or newly purchased in March 2022 and is due at May 2nd 2022. So, the truckers who own or operate the vehicles first used on March 2022 should know that they should report and pay their form 2290 truck tax to the IRS within the last date.

Pro-rated or Partial Period Form 2290 Truck Tax.

Enjoy the great customer experience at TruckDues.com to complete 2290 taxes online.

Hey there, wonderful truckers! IRS encourages all the truckers to e-file form 2290 online. And to make the process even easier, IRS delegated the e-filing service to the technical experts as its authorized modern e-file service providers. Truckdues.com is an IRS-approved modernized e-file service provider of form 2290 HVUT online. Truckdues got all the technical and security clearance from the IRS as per the rules and regulations to facilitate smooth e-filing of form 2290 between the taxpayers and the IRS.

Truckdues.com is the best e-file service provider for all American truckers. We offer a simple online platform and mobile applications for both Android and iOS users. So, you can use TruckDues on your personal computer, tablet, or smartphone at your convenience from the comfort of your home or office. Continue reading

How to get the refund claim that you owe back from the IRS on your heavy credit vehicles?

TruckDues.com is the most preferred electronic filing service provider for the Owner Operators and Small Medium size Trucking Companies to complete and pay the Federal Heavy Vehicle Use Tax (HVUT) Form 2290. We usually come across many questions at your help desk about how to claim the refunds on the credit vehicles that the IRS owe you back. Hope this article will be of useful information to understand and complete the refund claims electronically.

You can e-file Form 8849 schedule 6 for your refunds and credit claims from the IRS at truckdues.com. Register with TruckDues now!

How unique TruckDues is and how it stands out in the market to E-file form 2290.

Truckdues offers a convenient online platform to benefit the great American truckers and the trucking industry. Truckdues.com is a perfect user-friendly application to e-file the HUVT form 2290 online. As IRS is now advising all the taxpayers to report and pay their taxes online, we offer a comfortable service that helps our users to file 2290 online.

Truckduescom is the first company fully approved by the IRS as their modernized E-filing service provider. We are the pioneers in online E-filing heavy vehicle use tax and other similar taxes. And we got the opportunity to serve more and more American truckers during these pandemic times, as we provide an easy, contactless, and paper-free solution for paying the form 2290 tax. Continue reading

Pro Rated or Partial Period Form 2290 Tax Reporting on Heavy Vehicles

The Federal Heavy Highway Vehicle Use Tax returns on a Pro Rated basis or for the Partial Period Tax is now due on the heavy motor vehicles that is first used in August 2021. The 2290 taxes are calculated for the remaining months from the first used month instead of the 12 months tax period July 2021 through June 2022.

File Form 2290 for any taxable vehicles first used on a public highway after July 2021 has to be reported and paid by the last day of the month following the month of first use. For heavy motor trucks that is used in the month of August 2021 for the first time since the start of the tax year will be having the deadline on September 30, 2021. This is referred as Pro Rated 2290 Taxes.

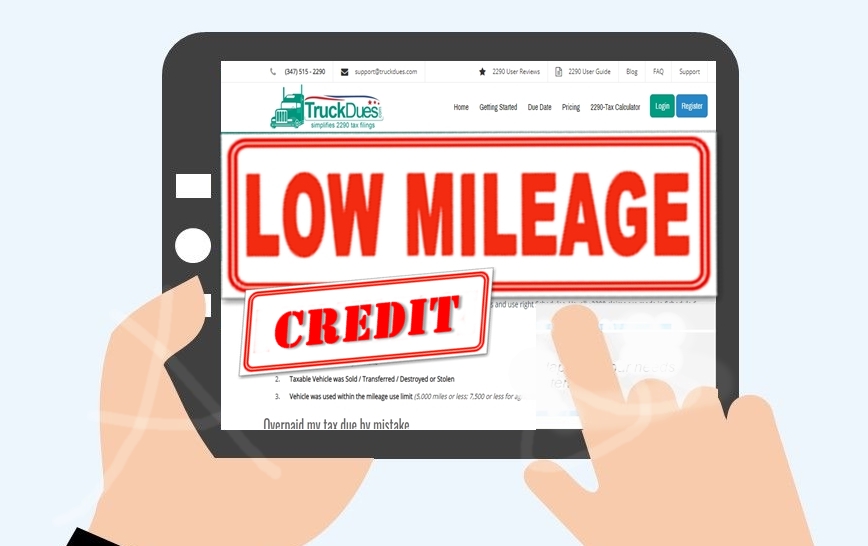

When do you use the low mileage credit?

Truckers, in this post, we’ll go through how to get a refund on your vehicle if you discover that you haven’t driven it over the desired mileage cap for exemption. The mileage cap for exemption, according to the Internal Revenue Service, stands at 5000 miles for commercial vehicles and 7500 miles for farming and logging vehicles.

The Heavy Highway Vehicle Used Tax Return HVUT Form 2290 is an annual tax charged to the Internal Revenue Service on vehicles with gross weights of over 55000 lbs and that is used for the same purpose every year. Form 2290 is due in June and is payable through the end of August.

Since Form 2290 must be filed upfront for the next 12 months, one must be certain of the miles the truck will be used. If the truck will be used within the exemption mileage, you will not have to pay any taxes to the IRS. We must only pay the IRS the tax due sum if we surpass the desired mileage cap of exemption. But what if you declare your truck as a taxable vehicle by mistake and pay the tax due, only to discover later that you have not driven up to the mileage limit? This is when you use the IRS’s low-mileage credit option, in which you use the IRS’s e-file Form 8849 schedule-6 to request a mileage refund and register the vehicle under low-mileage credits. This, though, can only be done after the existing tax year has finished and the new tax year has started.

Continue reading