Do you have a doubt whether your vehicle is

a logging vehicle or a commercial

vehicle? And do you want to know what would be the tax difference? Well

this blog is especially for those who have doubts on these areas. The most

common mistake that the filers commit while filing the Form 2290’s are in this

area. First let’s see what the difference between these two is.

Commercial vehicles are trucks that are

used to haul any type of goods except forest related products e.g. Hauling

timber and Logging vehicles are those trucks extensively used to haul only

forest related goods. The criteria for both these types are the same except for

the goods that they carry.

The vehicle mileage limit would be the same

i.e. 5000 miles for taxable category

vehicles and the taxes would be based on the gross weight of the vehicle (weight of truck + trailer + max load it can

carry) and for every 1000 lbs increase in weight starting from 55,000 lbs

there would be an increase in tax amount payable.

For a commercial vehicle with a gross

weight of over 75,000 lbs would be $550 for a whole tax year and for a

logging vehicle the total tax amount would be $412.50. The taxes for the Logging vehicle would be lesser than a

commercial vehicle considering the forest based products.

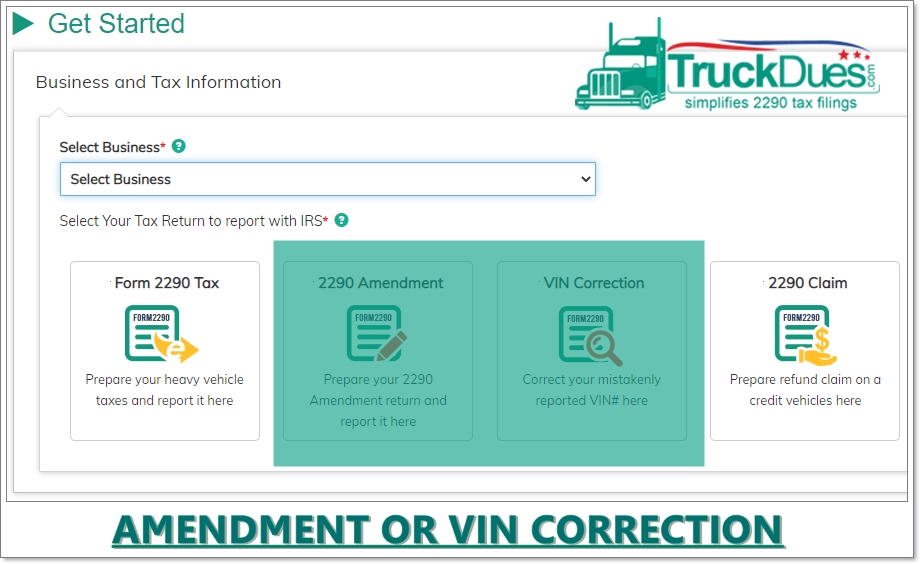

When you file your tax returns, please do

make sure that while entering your VIN details the logging vehicle category is

checked in case of declaring your truck as logging vehicle and vice versa. So

when you declare your vehicle make sure that these are noted, else if any

changes need to be made after filing should be done by contacting the IRS

directly which would consume your valuable time accordingly

Our Tax experts are striving to assist you

with your HVUT Form 2290 inquiries. Hence, feel free to reach us back at (347)

515-2290 between 9 AM to 5 PM Central Standard Time, Monday through Friday

except major federal holidays. Happy Trucking, God Bless America! God Bless our

Truckers!