Like many truckers who are really busy on road serving towards our nation’s economy, another group of professionals who are really busy in filing a bunch of Form 2290 reports for them clients during the appropriate deadlines known as Tax professionals or CPA’s (Certified Public Accountants). Continue reading

Like many truckers who are really busy on road serving towards our nation’s economy, another group of professionals who are really busy in filing a bunch of Form 2290 reports for them clients during the appropriate deadlines known as Tax professionals or CPA’s (Certified Public Accountants). Continue reading

Tag Archives: form 2290 e file providers

Today, we thank you, we salute you, we honor you Veterans!

In its 237 years, the United States has been involved in a dozen major wars to defend our nation, preserve our freedom and democracy, and serve our national interests. The major conflicts include the Revolutionary War, the War of 1812, the Mexican War, the Civil War, the Spanish-American War, World War I, World War II, the Korean War, the Vietnam War, the Gulf War, and the Wars against Terrorism, including the wars in Iraq and Afghanistan. Our armed forces have gone into harm’s way many other times, too. Continue reading

In its 237 years, the United States has been involved in a dozen major wars to defend our nation, preserve our freedom and democracy, and serve our national interests. The major conflicts include the Revolutionary War, the War of 1812, the Mexican War, the Civil War, the Spanish-American War, World War I, World War II, the Korean War, the Vietnam War, the Gulf War, and the Wars against Terrorism, including the wars in Iraq and Afghanistan. Our armed forces have gone into harm’s way many other times, too. Continue reading

Reporting a VIN Correction has been made Easy!

So you e-filed your HVUT 2290, but realize you made an error on your VIN, yet the IRS accepted it anyway. Don’t’ panic. The remedy is to file a VIN correction. By Filing a VIN correction, you’d only have to report the discrepancy of the previous tax return along with the required change on the alphanumeric charters of the Vehicle Identification Number. Continue reading

Truckdues Wishes you a Fun Halloween filled with magical surprises!

Keep Calm, It’s almost Halloween. Don’t forget to close all the doors and windows tonight. Cause the spirits today are out in the open. You can wish that you’re safe but I doubt that will happen. Strange things happen on a Halloween night.

Who in this world said Halloween is only for kids? That is Absurd, isn’t it? We got some cool ideas for adults who really wanted to enjoy Halloween not minding about what others would make fun of… Instead it’s really good to be a freak at occasions like Halloween than being an everyday Joe.

Here’s our 5 suggestions for you: Continue reading

You HVUT Form 2290 Is Due by Oct 31st, 2017!

Set the alarm, your Heavy Vehicle Use Tax (HVUT) Form 2290 is due by the end of this month. Form 2290 is generally due by the last day of the month following the month of its first use. On that basis, Oct 31st would be the deadline to file Form 2290 especially for vehicles that are been used on the road since September 2017.

Set the alarm, your Heavy Vehicle Use Tax (HVUT) Form 2290 is due by the end of this month. Form 2290 is generally due by the last day of the month following the month of its first use. On that basis, Oct 31st would be the deadline to file Form 2290 especially for vehicles that are been used on the road since September 2017.

Humans do commit errors which are naturally unavoidable at times. But when such human errors do occur whilst reporting your HVUT returns, it can cost you trouble with the Internal Revenue Service. So, at such unforeseen circumstances we need to file an Amendment, i.e., (The process of formally altering or adding to a record) which is available only when you E-File your federal HVUT returns. Following are the list of Form 2290 amendments available on www.truckdues.com: Continue reading

Basic Rejection Scenarios on HVUT Form 2290!

We realize that truckers are really busy on road and they always stay committed towards moving the nation’s economy forward. So they merely get a chance to remember the HVUT tax deadlines. Although when they remember that they haven’t filed one, they file it near the deadline in a last moment rush.

While doing so, in haste you might be welcoming careless mistakes, which would cost you heavy. A rejected return only means having it do all over again and no one would relish it! Yet, there is always a silver lining. By e-filing with www.truckdues.com instead of paper filing, you are already much less likely to make mistakes. Since, you’ve got our Tax Experts by your side, expertly answering all of your tax questions. So there’s no reason to file blindly and hope you’ve got it right! Continue reading

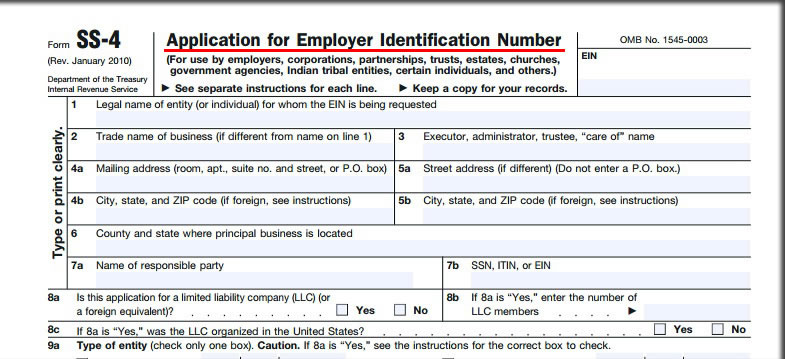

EIN is necessary during E-Filing your HVUT report!

Truckers, now we approach you with this article to make you aware of the necessity of Employer Identification Number while filing your HVUT online. To be precise on this fact, many independent owner operators face rejections on their Form 2290 application when filed with their Social Security Number. Hence, we would like to give you an example of the scenarios of misconception that takes place during E-filing your HVUT. Continue reading

Form 2290 is due in just a couple of weeks!

Today, we are approaching you with this article to remind you about the near term Form 2290 HVUT tax deadline which is due by Oct 31, 2017 for vehicles which are in operation since September 2017. Any Heavy vehicle that possess a minimum gross weight of 55000 lbs is liable to be reported on a Form 2290. But the Tax payment factor is determined by the number of miles traveled. When the vehicle exceeds 5000 miles in case of commercial based operation or 7500 miles in case of Agricultural purpose. When the vehicle doesn’t meet its desired mileage limit within a respective tax year the vehicle is basically classified to be exempt from paying the HVUT taxes to the Internal Revenue Service. However, the vehicle is required to be reported over the Form 2290 to justify its cause for exemption during audits & Road side inspections. Continue reading

Why e-filing is better than Paper Filing?

Greetings! You have landed at the right place in case you have been wondering why everyone’s talking laurels about e-filing over paper for long now. Obviously, you go green immediately, without wasting paper products of our beloved little left trees. The ability to file your tax returns round the clock throughout the week right at your desk at home makes life very comfortable and easy. The speed of the entire tax return process dramatically increases with e-filing over paper due to advanced INTERNET capabilities thus saving your hard earned money and energy worked out on postage/fax/courier/delivery charges, which of course can be used over a million other valuables. Continue reading

Greetings! You have landed at the right place in case you have been wondering why everyone’s talking laurels about e-filing over paper for long now. Obviously, you go green immediately, without wasting paper products of our beloved little left trees. The ability to file your tax returns round the clock throughout the week right at your desk at home makes life very comfortable and easy. The speed of the entire tax return process dramatically increases with e-filing over paper due to advanced INTERNET capabilities thus saving your hard earned money and energy worked out on postage/fax/courier/delivery charges, which of course can be used over a million other valuables. Continue reading

Reasons to E-file Your HVUT Return with Truckdues.com

Are you still in the Stone Age by paper filing your Excise Tax returns? Guess what, more than 70 percent of the taxpayers file their taxes electronically. The IRS has processed over a billion HVUT returns safely and securely since the past decade, the Official beginning of E-filing ERA. Very few still stick with paper filing Continue reading

Are you still in the Stone Age by paper filing your Excise Tax returns? Guess what, more than 70 percent of the taxpayers file their taxes electronically. The IRS has processed over a billion HVUT returns safely and securely since the past decade, the Official beginning of E-filing ERA. Very few still stick with paper filing Continue reading