Hello there

truckers, we receive calls from HVUT payers quite frequently wanting to know

what is the status of their refund claim. But as must know that the IRS remains

to be the sole decision maker in approving/disapproving any claims filed

electronically.

Generally

the IRS takes up to 21 business days before mailing the refund check to your

mailing address. But at times tax payers have reported us about non receipt of

the check from the government whereas such queries must be dealt directly with

the Internal Revenue Service as they are the deciding authority to go ahead and

perform investigation to identify the root cause behind the delay.

Generally there

are multiple reasons behind the delay of refund issuance and most common

reasons are delay in shipping, approval/disapproval from the IRS end despite successful

acceptance of your claim return electronically which will be notified by the

IRS only after a couple of weeks which further prolong the tentative timeframe,

besides weekends & Federal Holidays contribute their share to the delay as

well.

Hence, if

there was any delay in receiving the refund check back from the IRS you may

feel free to contact the IRS refund claim inquiry helpdesk @ (866) 699-4096 to know the exact reason

behind the delay and to know what are the additional documents which you need

to produce to re-initiate your claim.

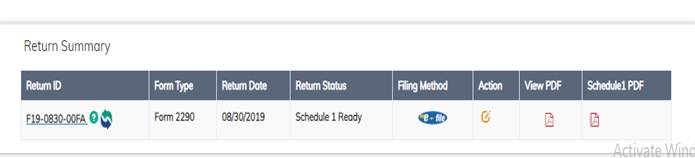

Also, for

your HVUT Form 2290 filing queries, Reach us back for any further

assistance over the following mediums:

Phone: (347) 515-2290 [Monday through Friday, 9

A.M to 5 P.M, Central Standard Time]

E-mail: support@truckdues.com

Live chat with our tax representatives.

Hello there truckers, this article is to remind you all that your Pro-rated HVUT Form 2290 is due by April 30, 2018 for the period beginning March 2018 through June 2018. As you are pretty aware of the fact Form 2290 is generally due by June and its payable until the end of August. Else, federal law states that Form 2290 must be filed on a vehicle by the last day of the month following the month of its first use.

Hello there truckers, this article is to remind you all that your Pro-rated HVUT Form 2290 is due by April 30, 2018 for the period beginning March 2018 through June 2018. As you are pretty aware of the fact Form 2290 is generally due by June and its payable until the end of August. Else, federal law states that Form 2290 must be filed on a vehicle by the last day of the month following the month of its first use.  Hey there truckers, we hope this article reaches you in high spirits. We’re sure that you know almost everything about a HVUT Form 2290. Although, we also feel that you must know about the Form 8849 Schedule 6 (Claim for Refund of Excise Taxes) to claim refunds on a vehicle that was earlier reported on a Form 2290.

Hey there truckers, we hope this article reaches you in high spirits. We’re sure that you know almost everything about a HVUT Form 2290. Although, we also feel that you must know about the Form 8849 Schedule 6 (Claim for Refund of Excise Taxes) to claim refunds on a vehicle that was earlier reported on a Form 2290.