Hello there dear Truckers! Hope you’re safe and sound amidst the pandemic. As you all know it’s just weeks before Form 2290 is up for renewal and it’s time to give some pointers and educate on the new and handy updates on our website to make your filings easier. Filing 2290’s has become easier as we always take a step closer to simplify out the process.

As you know you will be able to pre-file your tax returns for the tax year July 2020 – June 2021 with us we have brought a small update to the filing process, most of our customers call in to file the taxes for the same trucks and suggested if there was a cloning option to replicate the same filing as previously done. You’ve asked for it and we’ve done it.

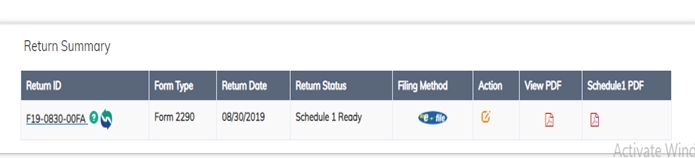

Steps to clone a return:

Continue reading