“Christmas is joy, religious joy, an inner joy of light and peace ” – Pope Francis

It’s time to trim the trees, wrap the gifts, and bake the cookies. We’re eagerly awaiting the arrival of Christmas! As we count down to the merriest day of the year. Usually the holidays are a time for reflection, for growth, for gratitude, and for renewing our commitment to our goals with fresh vigor.

Beyond the consumptive overdose of presents and the presence

of family and friends that accompany us during Christmas and New Year’s eve; It

is helpful to remember to take some time to be thankful, to literally be present

amongst the people who matter most in our lives, and to find some time for

solitude to gather the inner strength that will carry us onwards and upwards in

the new year.

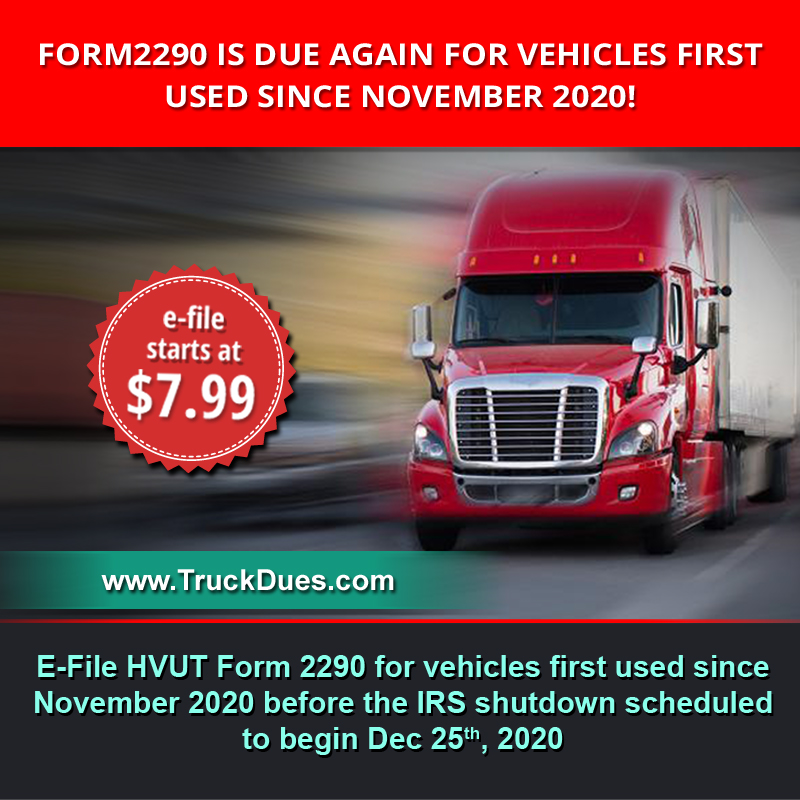

Also during this joyous time of the year, we would like to take this opportunity to keep you informed about the IRS scheduled Annual Maintenance period for 2018 which has been initiated to begin from December 26th, 2018 11:59 A.M, Eastern Standard Time up until 2nd week of January 2018. This initiative is been followed by the Internal Revenue Service every year with a motive to upgrade their e-file servers to accept the tax returns which are ought to be e-filed for the following tax period ( For the period beginning July 1st, 2019 through June 30th, 2020)

Now during this downtime, the IRS servers will not be able to process or accept any e-filed tax returns until the maintenance period is officially ceased by the IRS. Besides, we got a near term HVUT Form 2290 deadline by Dec 31st, 2018 for vehicles first used since November 2018. Hence, we recommend you to e-file your pro-rated HVUT Form 2290 before the IRS shutdown period to avoid any delays in getting your tax return processed.

Reach us back for any further assistance over the following

mediums:

Phone: (347) 515-2290 [Monday through Friday, 9

A.M to 5 P.M, Central Standard Time]

E-mail: support@truckdues.com

Live chat with our tax representatives.

May your Christmas be decorated with cheer and filled with love. Have a wonderful holiday!