Hello there

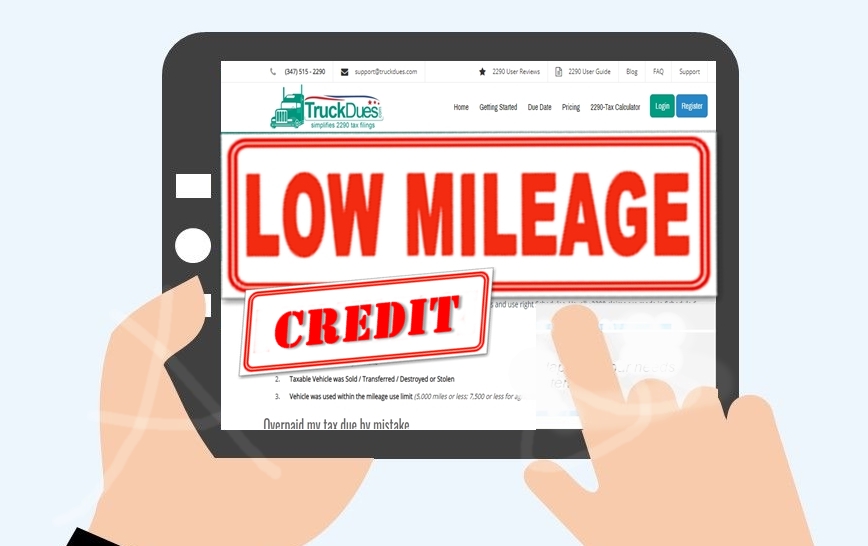

Truckers, over this article we are going to discuss on How to go about claiming

a low mileage vehicle credit for trucks that are used quite inactively over the

road. Most truckers are not really sure how to claim a refund on vehicles for which

the taxes were paid full in advance during the beginning of the tax period.

The Low

Mileage vehicle is basically claimed over trucks which were not used over the

desired mileage for exemption during the end of the tax period. Almost on a

daily basis, we receive queries from the HVUT tax payers saying that their

trucks are not in service due to mechanical wear & tear, engine related

issues, due to natural calamities etc.

Now if such

occurrences happen when the Tax Form 2290 was already filed for the subjected

vehicle, the owner of the vehicle must refer to the odometer reading to record

the number of miles the truck has covered until the period it was reported. If

that seems to be exceeding the desired mileage use of Exemption (5000 miles for Commercial based Units

& 7500 for Agricultural based

units) No further action is required from your end.

On the Contrary,

if the subjected vehicles seems not to have exceeded the desired mileage use of

Exemption (5000 miles for Commercial

based Units & 7500 for

Agricultural based units) then you are entitled to claim a full refund on the

taxes paid on this vehicle. However, you will only be able to claim this refund

after the current tax period officially ceases.

You may feel free to reach us back for further assistance

during your e-filing process over the following mediums:

Phone: (347) 515-2290 [Monday

through Friday, 9 A.M to 5 P.M, Central Standard Time]

E-mail: support@truckdues.com

Live chat with our tax representatives.

Have a Good One! See you over the next article.

Many truckers and trucking companies’ ends up making an overpayment towards their HVUT Form 2290 taxes due to various reasons likely, they would have been into the conventional way of paper mailing the Physical Form stapled with a payment and receives the proof of payment back in mail in a fortnight, however this doesn’t seem to be a trouble until it costs any individual owner operators or trucking firms an immediate registration. So, many truckers who anticipates a response beck from the IRS out of paper mail ends up e-filing too so there comes an over payment of taxes by both mediums.

Many truckers and trucking companies’ ends up making an overpayment towards their HVUT Form 2290 taxes due to various reasons likely, they would have been into the conventional way of paper mailing the Physical Form stapled with a payment and receives the proof of payment back in mail in a fortnight, however this doesn’t seem to be a trouble until it costs any individual owner operators or trucking firms an immediate registration. So, many truckers who anticipates a response beck from the IRS out of paper mail ends up e-filing too so there comes an over payment of taxes by both mediums.