Though it’s not August now, it doesn’t mean that you can’t renew your Form 2290 for the Period beginning July 1, 2017 through June 30, 2018. You may E-file them now via www.truckdues.com. It’s no obvious that truckers miss their tax deadline due to their busy on road schedule. But extended procrastination might get you into a trap full of late filing fee & Interests facing against you. Continue reading

Though it’s not August now, it doesn’t mean that you can’t renew your Form 2290 for the Period beginning July 1, 2017 through June 30, 2018. You may E-file them now via www.truckdues.com. It’s no obvious that truckers miss their tax deadline due to their busy on road schedule. But extended procrastination might get you into a trap full of late filing fee & Interests facing against you. Continue reading

Missed your Chance to E-file Form 2290, Well No worries, E-File Now!

If this rings a bell in your mind, probably you missed your HVUT Form Renewal. The Deadline to E-Renew Form 2290 for the period beginning July 1, 2017 through June 2018 was Aug 31, 2017. However, we realize that everyone can’t really afford time to spare towards E-filing Form 2290 during this time due to their busy work schedule. Hence, it doesn’t mean that it’s the end of the road. You may still renew your Form 2290’s now for the Period beginning July 2017 through June 2018 right now to stay away from incurring more penalties towards late filing and late payment of HVUT taxes. Continue reading

If this rings a bell in your mind, probably you missed your HVUT Form Renewal. The Deadline to E-Renew Form 2290 for the period beginning July 1, 2017 through June 2018 was Aug 31, 2017. However, we realize that everyone can’t really afford time to spare towards E-filing Form 2290 during this time due to their busy work schedule. Hence, it doesn’t mean that it’s the end of the road. You may still renew your Form 2290’s now for the Period beginning July 2017 through June 2018 right now to stay away from incurring more penalties towards late filing and late payment of HVUT taxes. Continue reading

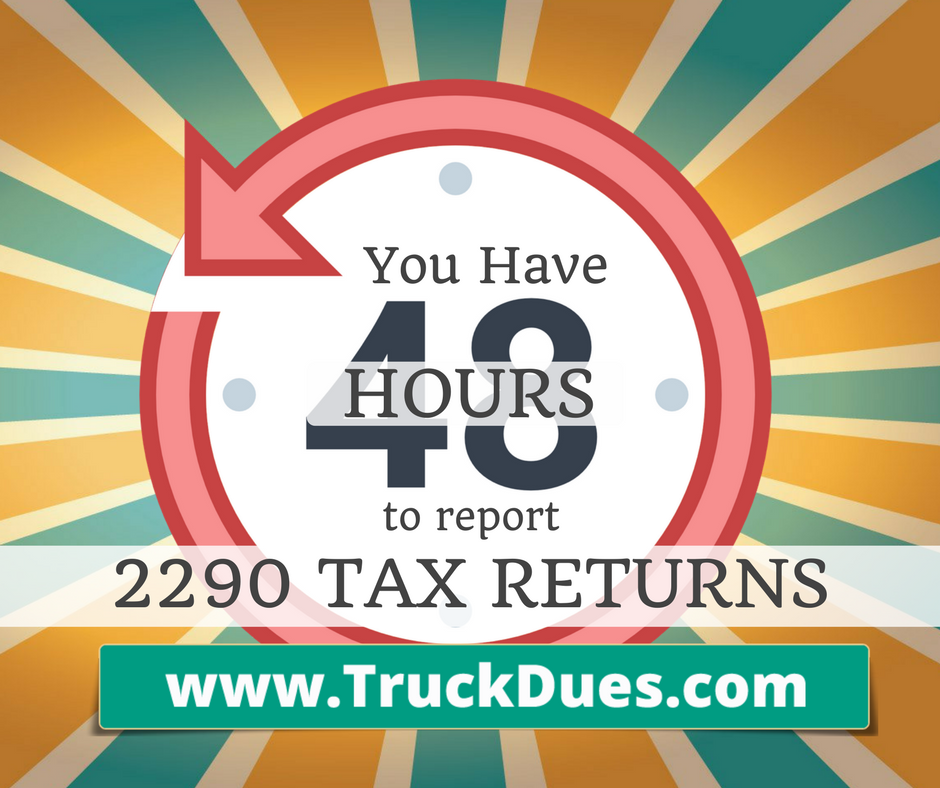

2290 Tax e-File Countdown : Just few hours left to report it with IRS

Less than a day to have your Form 2290 and Schedule-1 renewed with the IRS, August 31 is the due date. High time to get it reported and renewed online in simple steps and fast process.

If you own and operate a heavy motor truck with a taxable gross weight of 55,000 pounds and more, your are liable to report and pay 2290 truck taxes. It is simple and easy when you do it online with TruckDues.com an IRS authorized e-file service provider.

Form 2290, the heavy highway vehicle use tax is a fee assessed annually on vehicles that operate on public highways. Form 2290 is reported and paid in full by August 31, today is the deadline to have this 2290s reported with the IRS.

Electronic filing automates your tax preparation, you just key in your vehicle details with the tax year and first used month, taxable gross weight along with your Vehicle Identification Number (VIN), your tax return is ready with inputs to file it with the IRS. It is simple and easy as 1-2-3..!

Electronic filing is the fastest way of filing your 2290 tax returns with the IRS, once you complete your tax return it is consolidated and sent to the IRS for processing. IRS verify the data and approves your Schedule-1 with an e-file watermark (stamp) which very well used as a proof for payment of taxes.

Delaying further would end up IRS audits, late fee and paying extra on top of your tax due. E-File is 100% accurate, fast, simple and secured. All the tax math happens automatically, 100% fast, IRS would process your 2290s immediately, and pushed to your email in-box once it is accepted.

Alert: Just 48 left until your Form 2290 Deadline!

Truckers, we are now just at a couple of days away from the HVUT tax deadline. Just 48 hours left until renewing your Form 2290 for the period beginning July 1, 2017 through June 30, 2018. All the last moment filers are online now to E-renew them Form 2290’s. In case you haven’t e-filed your Form 2290 yet, Log on to www.truckdues.com and e-file your Form 2290’s ASAP and receive the IRS watermarked copy of schedule 1 in your e-mail instantly. Continue reading

Truckers, we are now just at a couple of days away from the HVUT tax deadline. Just 48 hours left until renewing your Form 2290 for the period beginning July 1, 2017 through June 30, 2018. All the last moment filers are online now to E-renew them Form 2290’s. In case you haven’t e-filed your Form 2290 yet, Log on to www.truckdues.com and e-file your Form 2290’s ASAP and receive the IRS watermarked copy of schedule 1 in your e-mail instantly. Continue reading

Just 4 days left before your Form 2290 Deadline! E-file Now!

Truckers, it’s now high time to E-file your Form 2290 for the period beginning July 1, 2017 through June 30, 2018. Several thousands of tax payers, who procrastinated on their HVUT deadline, would be braced now to E-file their Form 2290 at the very last moment. Things done at the last moment creates space for human errors. So, after you read this article you must be aware that you’re almost near the deadline as its due in just 4 days and we don’t want you to prolong it anymore. Continue reading

Truckers, it’s now high time to E-file your Form 2290 for the period beginning July 1, 2017 through June 30, 2018. Several thousands of tax payers, who procrastinated on their HVUT deadline, would be braced now to E-file their Form 2290 at the very last moment. Things done at the last moment creates space for human errors. So, after you read this article you must be aware that you’re almost near the deadline as its due in just 4 days and we don’t want you to prolong it anymore. Continue reading

E-Renew your 2017-2018 Form 2290 as we merely got a week’s time until Deadline!

Time waits for none, it really matters how we efficiently utilize the time in getting our works done. The same saying applies when it comes to your HVUT Form 2290 deadline, The IRS let you e-filing your Form 2290 for the period beginning July 1, 2017 through June 30, 2018 since the beginning of July 2017. They gave you 90 days before you can e-renew your Form 2290, by far 55 days has passed by, hence we got very less time left behind to meet the deadline. Continue reading

Time waits for none, it really matters how we efficiently utilize the time in getting our works done. The same saying applies when it comes to your HVUT Form 2290 deadline, The IRS let you e-filing your Form 2290 for the period beginning July 1, 2017 through June 30, 2018 since the beginning of July 2017. They gave you 90 days before you can e-renew your Form 2290, by far 55 days has passed by, hence we got very less time left behind to meet the deadline. Continue reading

Comparison between AAOO & OOIDA

The American Association of Owner Operators (AAOO) is a nationwide association created to benefit professional truckers and small fleet owners. The Owner-Operator Independent Drivers Association (OOIDA) is the international trade association representing the interests of independent owner-operators and professional drivers on all issues that affect truckers. There is an interesting post in AAOO site comparing both these bodies and here it is for your review… Continue reading

Less than a couple of weeks left until your Form 2290 Deadline!

So, how was your experience witnessing the all American total eclipse yesterday? It would sure have been a joyous moment for many across the nation to witness the once in Life time path of Totality. However, now the eclipse is over so does yesterday. Continue reading

So, how was your experience witnessing the all American total eclipse yesterday? It would sure have been a joyous moment for many across the nation to witness the once in Life time path of Totality. However, now the eclipse is over so does yesterday. Continue reading

Be prepared to witness the Rare 2017 Path of Totality on Aug 21st!

Millions of people are extremely excited and are traveling enormous distances to witness the full eclipse and the path of totality. The Great American Eclipse will cast a shadow over the whole country, moving diagonally from Oregon in the northwest to South Carolina in the southeast. Continue reading

Millions of people are extremely excited and are traveling enormous distances to witness the full eclipse and the path of totality. The Great American Eclipse will cast a shadow over the whole country, moving diagonally from Oregon in the northwest to South Carolina in the southeast. Continue reading

Renew your Form 2290 for 2017 – 2018 Today, its Due in a Fortnight!

We are half past August, yet we got merely 15 days left behind to E-file your Form 2290 for the Period beginning July 1, 2017 through June 30, 2018 since Form 2290 is generally due by June and its payable until the end of August, by E-filing sooner you’d be avoiding a last moment rush near the tax deadlines to get things straightened out. Hence, when it comes to your tax filings the sooner will be always the better. Continue reading

We are half past August, yet we got merely 15 days left behind to E-file your Form 2290 for the Period beginning July 1, 2017 through June 30, 2018 since Form 2290 is generally due by June and its payable until the end of August, by E-filing sooner you’d be avoiding a last moment rush near the tax deadlines to get things straightened out. Hence, when it comes to your tax filings the sooner will be always the better. Continue reading