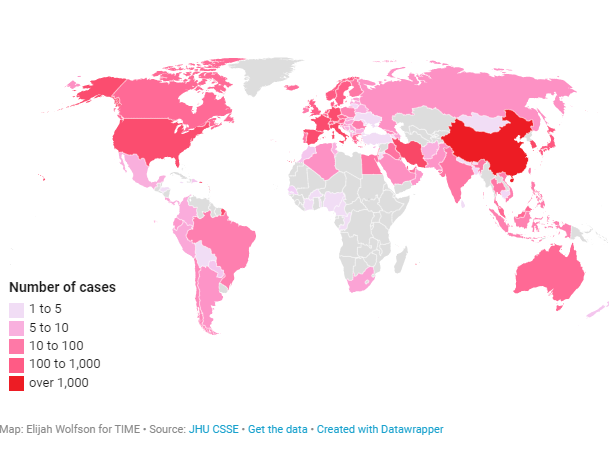

COVID-19 has brought great sadness in the history of mankind, a strong scar to always be remembered. Yet amidst of all these commotions goodness shines bright giving us hope and endurance to face every boulder in our way. Staying strong and positive is key to overcome this pandemic disease as signs of goodwill is what we see daily across the nation. People are instructed to follow social distancing protocols, staying indoors and away from loved ones to avoid the spread of COVID-19. These measures have caused a higher level of panic and anxiety for Americans.

Food is one of the important concerns for our truckers who are working day and night to meet our necessities. Bill Garrett, senior vice president of operations for McDonald’s, discussed the new ordering system and pledged to support U.S. truckers as they deliver needed goods during the COVID-19 pandemic. Though most of the diners are closed, many restaurants in order to stay in business have closed the dining sections and keep take out available. But driving a truck through a drive-in is not practical and hence the new implementation of food ordering systems for our truckers. McDonald’s is encouraging truckers to use the following procedures:

- Use McDonald’s Mobile Order & Pay app, when

you arrive at the restaurant

- Select Curbside Service and walk to the

designated Trucker curbside sign on the sidewalk outside our designated door

- Complete your order by entering the appropriate

Trucker curbside number and we’ll bring your order to you at the designated

door as soon as it’s ready

“As the world continues to address the quickly changing

landscape, we are in this together with you, our valued friends in the trucking

and transportation industry. Thank you for everything you are doing to keep

essential parts of our economy going,” said Garrett.

A fire department located in 45th Street in Little Rock, AR have opened up their doors to feed the truckers at no cost. The area near the facility has ample amount of space to park and the area around it has quite a bit of 18 wheeler traffic due to the industrial park. To feed the ones who feed us is the motive for this good gesture.

The Missouri Department of Transportation announced a free, temporary overweight permit that allows haulers to transport up to 100,000 pounds on any Missouri highway through April 30 to assist in the critical flow of essential goods during the COVID-19 crisis, including interstates, as long as certain criteria are met:

- A copy of the special permit and a bill of

lading must be in the possession of the operator of the overweight vehicle

during its operation and shall be produced for inspection upon request to any

Missouri law enforcement official and/or any MoDOT employee.

- The load must carry supplies and/or equipment in

the direct effort to prevent, contain, mitigate and treat the effects of the

COVID-19 virus. This includes shipments of livestock, poultry, feed and fuels.

Any fuels being transported can be hauled at 100,000 lbs. or up to the

manufacturer’s specifications of the tank type being operated, whichever

results in the lower weight.

- Undertaking movement is evidence that both the

owner and operator of the equipment agree to abide by the conditions of the

special permit and all other non-exempted requirements for overweight loads.

- Carriers may haul up to 100,000 lbs. gross

weight on semi-trailer configurations with five or more axles. The axles must

meet the minimum distance requirement stated in the special permit. Carriers

using trucks or semi-trailers with fewer axles are allowed to haul up to an

additional 10% heavier than licensed weight.

- Carriers and vehicle operators must obey all

structure postings and size and weight restrictions.

- Violation of any of the conditions of the

special permit will void the permit and subject the owner and operator to

penalty.

“We are trying to help make the movement of needed goods more efficient,” said MoDOT Director Patrick McKenna.

The Transportation training company Instructional Technologies Inc. (ITI) is offering a free online course for drivers on COVID-19 safety. COVID-19: What Drivers Need To Know helps drivers understand the impact of the coronavirus pandemic, how it could affect their work and safety, and steps to keep themselves and others safe. ( https://youtu.be/Ma1wuYGXNvs )

We as a team are open and working remotely to assist you with all your Form 2290 needs and are ready at your service through calls, chats and email support. Feel free to contact us at 347-515-2290 or just drop an email to support@truckdues.com. Let’s stay strong and be safe and walk through this storm to see a brighter day.