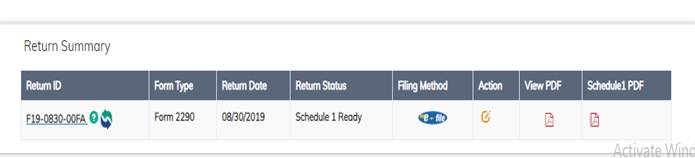

Truckers working hard to make sure that the essentials are shipped across the country. It is July and the Federal Heavy Vehicle Use Taxes falls due for the new tax period. TruckDues.com committed to offer the electronic filing service to the trucking community with more simplified features. We understand the importance of your business and are working persistently in effort to minimize disruptions associated with COVID-19. You can completely rely on us for your 2290 tax reporting as we have taken adequate steps to support you and your business with 2290 efiling. Electronic filing guarantees no blind spot or roadblocks, an easy walk through and faster process. IRS watermarked digital Schedule 1 Receipt instantly shared to your inbox. It is as simple as you read it… come experience the difference with TruckDues.com