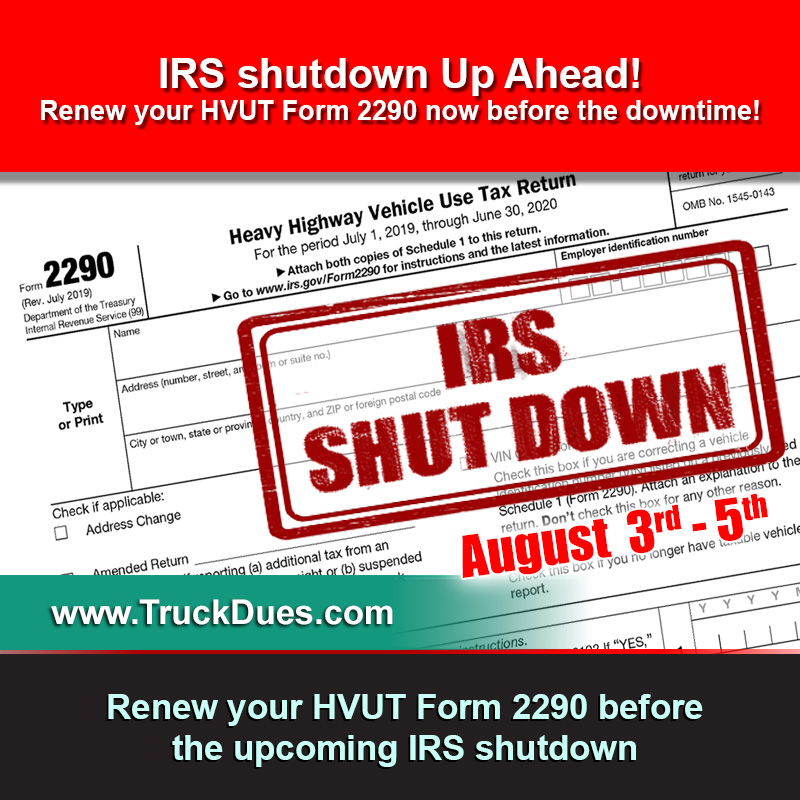

Truckers, the Pro-rated Heavy highway vehicle used tax return is now due by 09/30/2019 for vehicles first used since August 2019. This deadline is drafted based on the Federal law that states that the Form 2290 must be e-filed on a vehicle by the last day of the month following the month of its first use. On that basis, the HVUT Form 2290 is now due by 09/30 for vehicles first used since Aug 2019.

The Heavy Highway vehicle used tax return is basically paid on Heavy vehicles with a taxable gross weight of 55000 lbs or more and if the same is been used over the public highways for commercial, Agricultural & Logging purposes.

If the said vehicle is expected to be operated over 5000 miles for Commercial based units and over 7500 miles for Agricultural based units then tax due is required to be paid on these trucks upfront for the upcoming 12 months. On the other hand, if the vehicle seems to be used under the mileage limit then the truck turns out to be exempt and no taxes are required to be paid on such vehicles.

The Annual HVUT Form 2290 is basically due by June and its payable until the end of August, for the current year the HVUT Form 2290 for the period beginning July 1, 2019 through June 30, 2020 was due since June 2019 and the actual deadline was extended up until Sept. 3, 2019. We realize that most of the truckers might have missed on the deadline due to busy on road schedule. For those, we want you to know that now it’s not too late to renew your Form 2290 to avoid maximum penalties from the IRS.