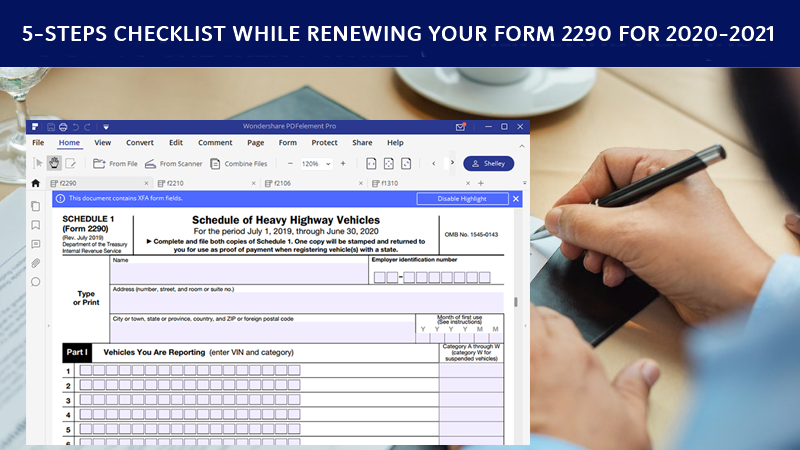

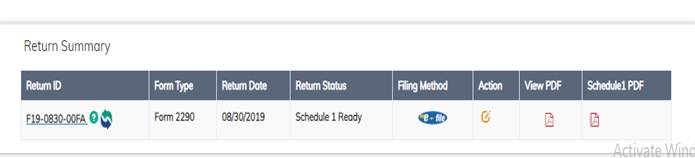

Hello Truckers, hope you’re busy in between your 2290 Tax Season. We just need to add more details to your 2290 tax preparation process and remind you that eFile can help you big time to handle this 2290 taxes with ease. TruckDues.com is the most preferred eFile website for Owner Operators and helps them to receive the IRS watermarked Schedule 1 receipt instantly. August 31 is the Due Date to report and pay the Federal Vehicle Use Tax ?Form 2290 on your heavy highway motor vehicle.