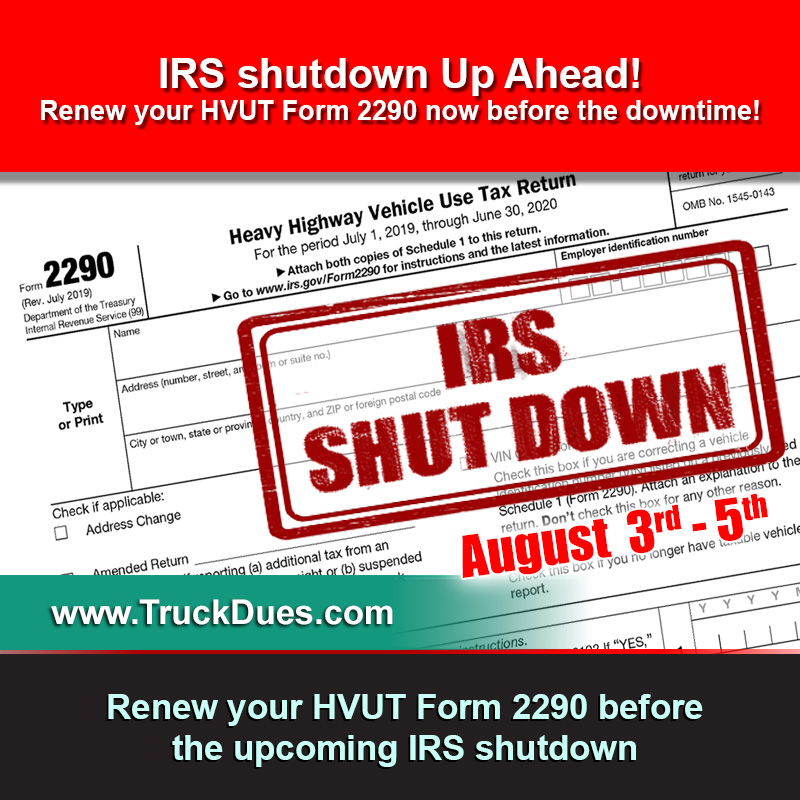

Hey there truckers, No wonder misconception might arise within yourself due to our repeated HVUT deadline alerts. We are not trying to mock you with repeated deadline alerts. Federal law states that HVUT Form 2290 must be filed on a Vehicle by the last day of the month following the month of its first use.

Hence, this article about the HVUT deadline must concern you only if you had purchased/re-purchased any truck and that’s being used over the road since Sep 2019, whereby you are required to E-File & pay the HVUT to the IRS on or before 10/31/2019.

Failure to E-file the Form 2290 before the deadline might end up in owing the IRS a penalty for late in filing & payment. This penalties might fluctuate between 3 to 5% of the overall tax due owed on your vehicle and the worst part is the interest will accumulate on daily basis as long as you prolong the lateness beyond the desired deadline assuming it as an extension. In the first place we would like to make our dear truckers aware that there has been no extensions for Form 2290.

Truckdues.com has been rated to be one of the moist efficient & cost effective websites which makes the e-filing process easy even for beginners. There are no complex calculations involved as our application bears that part on your behalf as it has an inbuilt tax calculator for your convenience. Soon after you enter your vehicle information, our application would calculate the tax due amount of the vehicle reported.

We request the trucking community to feel free while contacting our Tax expert support @ (347) 515-2290 during your HVUT Form 2290 filing needs.