Yes you heard it right it’s just a couple weeks’ time left to file your taxes, But you might ask, Why now? Well, do u have a new vehicle to report which is yet to be filed? Now is the right time to do it. As per the IRS regulations it’s mandatory to file your vehicle for tax purposes, in failure to do so will attract penalty for late filing and payments of taxes.

So why waste on extra cash when you can prevent if by filing with us, for a mere $7.99 you would be able to file your taxes and also do any corrections through our website.

So when, what and how should it be done? We have the solutions for you and here are some common questions that we come across on day to day basis:

When should I pay?

As per the IRS it’s mandatory for all new vehicles to file the vehicle by the last day of the following month of its first use.

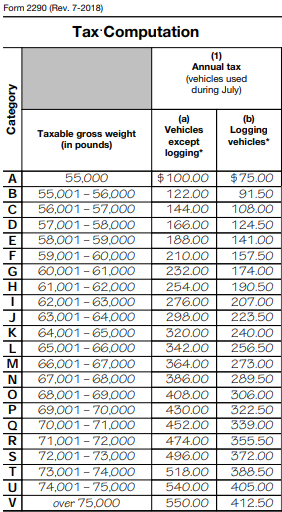

Should I pay for the whole year?

No, the taxes are calculated based on the first month of use till June 30th, so the taxes will be calculated for the number of months used and miles to be driven (taxes are applicable for vehicles mileage over 5,000 or 7500 for agricultural vehicles)

Why us?

- When truckers are busy providing services for all the need of our country, we are here to help our patriots to do the filings on the go.

- Truckdues.com is a dedicated portal for all your 2290 tax filings and corrections, with 100% accuracy in calculating your taxes and minimalizing your work truckdues.com is a one stop shop for all your tax filings.

- Just upload your business details and your vehicles information on our website and sit back and let us do the work for you.

- Made any mistakes while uploading your details? No worries we can cover it up for you, register with us for just $7.99 for your tax filings and do the corrections for free.

- Why wait in a long queue when you can do the same on your mobile phone? Yes truckdues.com is available on all major platforms making it easier to all the truckers to do their filings on the go with minimalized error and quick response the entire process would just a few minutes of your precious time , you can hit the road without and worries since we’ve got your back

Here at truckdues.com we avail multiple and secure modes of payment options, authorized by the federal govt. So why to worry? E-File your 2290 tax returns in a swing of a baseball bat using www.truckdues.com to receive an instant confirmation back in your e-mail.

You may feel free to reach us back for further assistance during your e-filing process over the following mediums:

Phone: (347) 515-2290 [Monday through Friday, 9 A.M to 5 P.M, Central Standard Time]

E-mail: support@truckdues.com

Live chat with our tax representatives.

Have a Good One! See you over the next article.