Hello, Truckers! Again, the tax season is upon us for the year, and we all want to smoothly file our form 2290 truck taxes to the IRS, pay the tax dues, and get the IRS-approved schedule 1 copy to continue the trucking operations.

Form 2290 HVUT

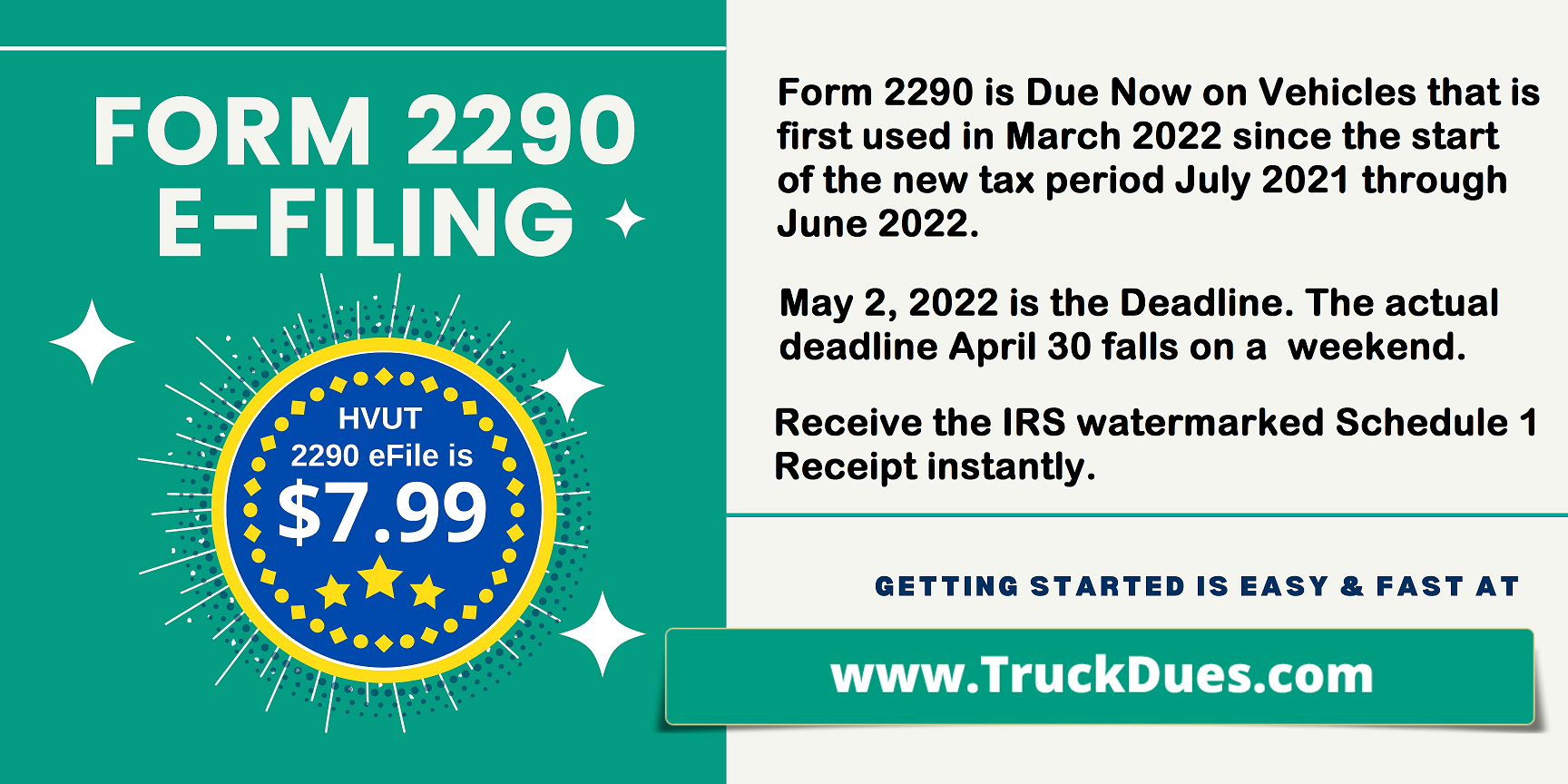

IRS charges the Highway Heavy Vehicle Use Tax for all heavy vehicles and trucks through form 2290 every year to use the public highways of the United States. Therefore, truckers and trucking taxpayers like truck owners, owner-operators, and business owners should file their form 2290 truck taxes to the IRS in advance for the year’s tax period.

The tax period for this year starts on July 1, 2022

Generally, the tax period starts around the first week of July and lasts till the end of the next June. So, the tax period for this year is from July 1, 2022, to June 30, 2023. Therefore, truckers should report their form 2290 tax reports from July 1 and get their schedule 1 copy soon. The deadline to file form 2290 truck taxes for the upcoming tax period is August 31, 2022. You should stay alert and report your truck taxes within the deadline. Else, IRS will charge hefty penalties and late charges on your tax dues. On the other hand, operating your trucks or heavy vehicles on public highways is impossible without a valid schedule 1 copy. Continue reading

Continue reading