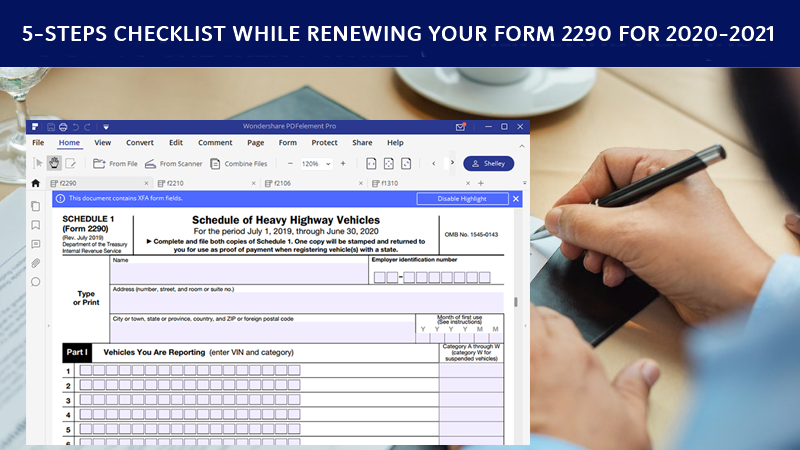

Truckers, we got to remind you about the upcoming HVUT tax deadline by November 30, 2020 for vehicles first used since October 2020. This deadline has been drafted based on the Federal Law that indicates that Form 2290 needs to be filed by the last day of the month following the month of its first use.

This deadline is considered to be applicable for vehicles that are purchased/re-purchased or in use since October 2020. This deadline does not have any impact on regular annual renewals done in July & August of every year.

The Heavy Highway vehicle used taxes are generally paid on vehicles with a minimum taxable gross weight of 55000 lbs or more and if the subjected vehicle is used on the public highways for commercial & agricultural purposes.

Unlike the other taxes, Form 2290’s are always been filed and paid upfront for the upcoming period. Hence, one must be sure of the fact if the truck would exceed the desired mileage limit for an exemption to pay the tax dues full in advance whereas if the truck might underrun the said limit to claim a complete exemption from paying taxes to the IRS.

As we are looking forward to Thanks Giving it is wise enough to file your pro-rated form 2290 right was which could eliminate last-minute rush up and you can relax during the long weekend

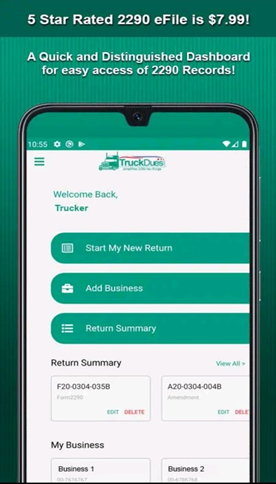

E-Filing HVUT Form 2290 via www.truckdues.com hardly consumes few minutes of your busy on road schedule. You don’t have to spare a lot towards hiring a high-priced professional to assist you with your 2290, instead, you can e-file your HVUT right off your PC or smartphone and get the services rendered as low as $7.99. Receive the IRS digital watermarked copy of schedule 1 in the email minutes after you e-file. Reach our tax experts @ (347) 515-2290 for any further assistance.