Hello truckers and truck taxpayers, you may be getting ready to file your form 2290 tax reports for the upcoming tax period, or you may have already pre-filed form 2290 ahead of the tax period. Now, it’s time to report your form 2290 truck taxes for your heavy vehicles first used in May 2022. The pro-rated form 2290 truck taxes for the heavy vehicles or trucks first used in May are due by June 30, 2022. So, we request all the truckers with heavy vehicles first used in May 2022 to report your form 2290 truck taxes today at TruckDues.com and get the schedule 1 copy to your respective email address.

Form 2290 truck tax is mandatory for all taxable heavy vehicles.

All the taxable heavy vehicles or trucks should report and pay their truck taxes using form 2290 every year to ensure a smooth operation on the public highways. If not, the IRS will charge huge penalties, late charges and interests over your pending form 2290 tax payments. The heavy vehicles or trucks that come into the taxable category are entitled to report and pay form 2290 truck taxes in advance during the tax period. Form 2290 truck taxes are always charged in advance, so truckers should estimate their taxes based on their truck operation and pay them accordingly to the IRS. So, your truck must have a total gross weight of over 55,000 pounds and should run over 5,000 miles (7500 miles for logging vehicles) on the public highways to come under the taxable category. All truckers with taxable heavy vehicles should pay form 2290 truck taxes to the IRS and get the official schedule 1 copy. The heavy vehicles or trucks that don’t come under the taxable category also should report form 2290 HVUT to the IRS as tax-suspended vehicles.

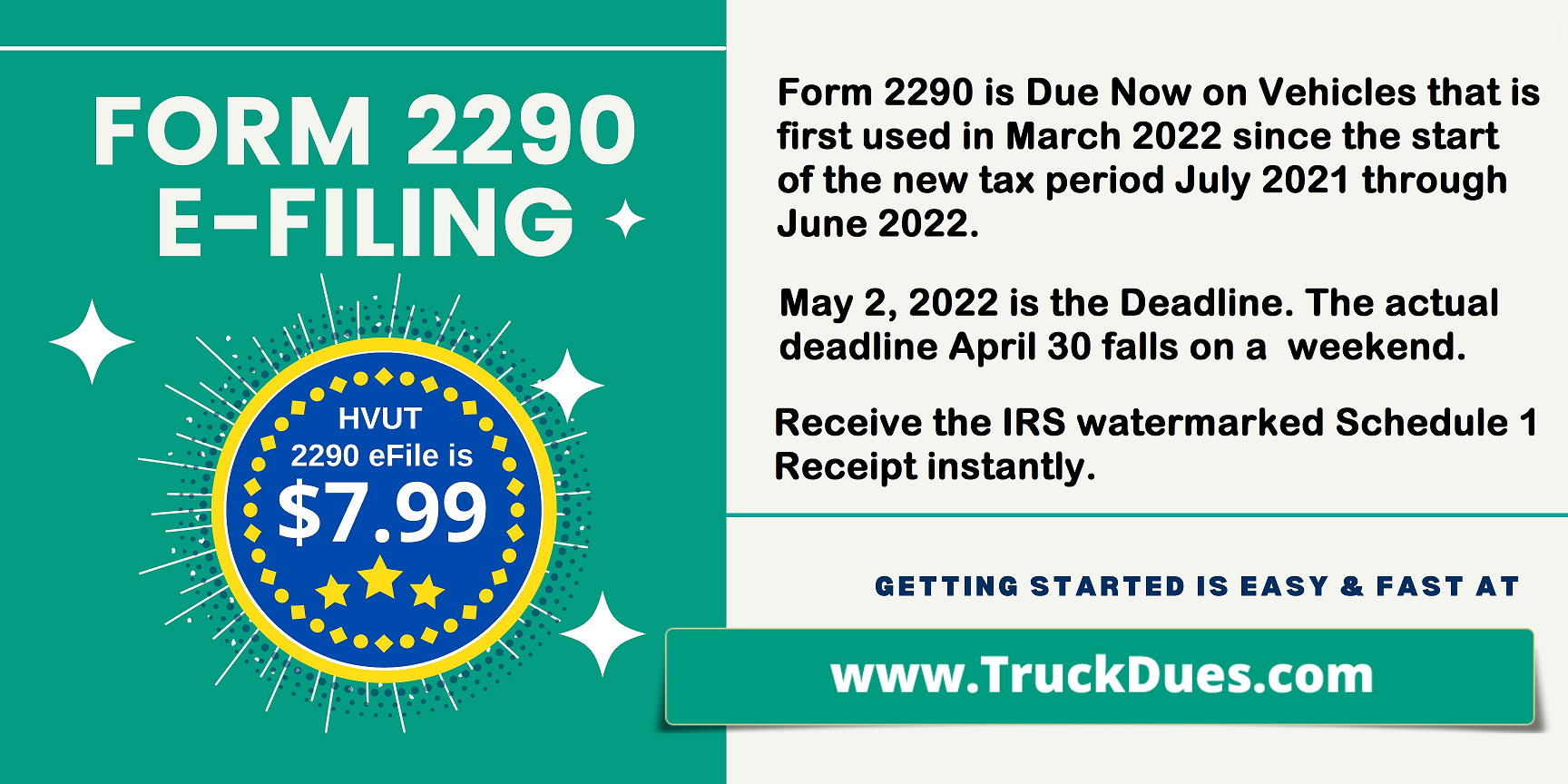

Its shout-out time! The deadline to file form

Its shout-out time! The deadline to file form