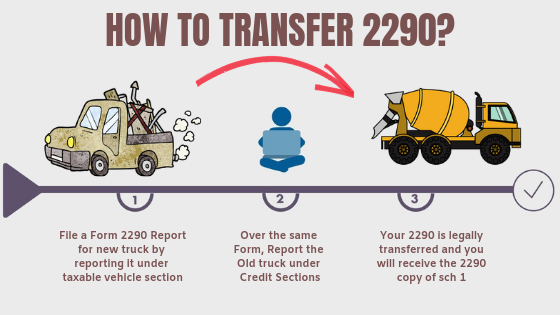

Hello there Truckers, most of you all would think how to transfer your 2290 from the old to new unit. Well here’s the answer, it’s simply done over a regular Form 2290. Generally when you e-file the Form 2290 you know that you always make the tax payment to the IRS full in advance.

So if you had sold a vehicle amidst a tax period for which you have made the tax payment full in advance. You may certainly claim a partial refund or an adjustment of tax credits to the replacement unit. If you had not bought any replacement unit versus the sold vehicle you may simply opt for a tax refund which is done by filing the Form 8849 Schedule 6 (Claim for refund of excise taxes). Upon a successful submission of your claim request, takes 21 business days before the IRS could mail you the refund check.

On the other hand, if you had purchased a replacement unit versus the sold vehicle, you may go ahead and claim a partial credit carryover towards the Pro-rated tax due amount of the new replacement unit. By this way, you would be able to nullify your tax due (In case of same month remains in common for both sold & newly acquired unit) & pay the difference in excess post adjustment (In case of same month does not remains in common for both sold & newly acquired unit).

However, the vehicle that was sold would never reflect over your copy of Schedule 1 as the IRS systems would only reflect taxable units and suspended/exempt units determined based on the desired mileage use of the vehicles. Whereas vehicles reported under credit sections would not show up on the actual stamped version of Schedule 1 although it does remain accountable for your credit adjustment in the backend.

Truckdues.com is rated to be one of the most efficient & cost effective priced websites that support HVUT Form 2290 filings electronically. We ensure zero tolerance towards any errors that might occur whilst the e-filing process. The best part of e-filing is the turnaround time where it just takes few minutes before receiving the IRS digital watermarked copy of schedule 1 back in your e-mail.

Reach us back for any further assistance over the following mediums:

Phone: (347) 515-2290 [Monday through Friday, 9 A.M to 5 P.M, Central Standard Time]

E-mail: support@truckdues.com

Live chat with our tax representatives.

Have a Good One! See you over the next article.

Truckers, may we have your kind attention please. You all know very well that the HVUT Form 2290 is generally filed every year during July through Aug. However, when it comes to the Pro-rated HVUT Form 2290 the IRS has a different deadline as per their law, the deadline to E-File a Pro-rated HVUT Form 2290 must be the last day of the month following the month of its first use.

Truckers, may we have your kind attention please. You all know very well that the HVUT Form 2290 is generally filed every year during July through Aug. However, when it comes to the Pro-rated HVUT Form 2290 the IRS has a different deadline as per their law, the deadline to E-File a Pro-rated HVUT Form 2290 must be the last day of the month following the month of its first use.

Hello there truckers, over this article we are now going to discuss about the advantages f e-filing your HVUT Form 2290. Most of you all know that Form 2290 was basically mailed by paper and anticipate a response back from the Internal Revenue Service in a delayed fashion. However this was only until e-filing could emerge as the revolutionary way of easing up processing of reporting and filing your HVUT tax Form 2290 to the Internal Revenue Service.

Hello there truckers, over this article we are now going to discuss about the advantages f e-filing your HVUT Form 2290. Most of you all know that Form 2290 was basically mailed by paper and anticipate a response back from the Internal Revenue Service in a delayed fashion. However this was only until e-filing could emerge as the revolutionary way of easing up processing of reporting and filing your HVUT tax Form 2290 to the Internal Revenue Service.