Hello there dear truckers, hope you’re all safe and sound. It’s been a chaotic year so far as the whole world plunges due to the outburst of coronavirus. It’s a life-threatening situation out there and we urge you all to stay safe. Keep you self well equipped and sanitized to minimize any sort of contamination. Truckers travel as far as the eyes can see connecting every inch of our nation to support our daily needs. As the whole nation is quarantined and the virus still spreading out there you are risking your lives for us, though you are highly exposed to this pandemic.

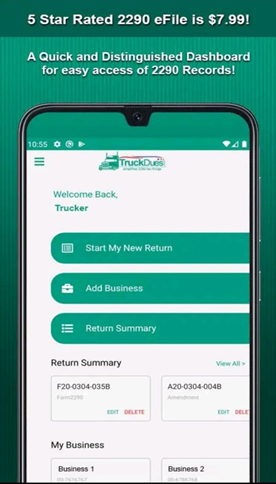

The Government urges all of its citizens to stay home and work from home but when it comes to trucking you can’t. What would be the best help that we could do? a question put into the process and as an initiative step, we have developed our mobile application for android users. Yes! we may not be the first but certainly not the last. As a result of our technology team, we are now available on mobile platforms to file your form 2290 taxes.

The application is now available on play store or follow

this link to download your app today for free! https://play.google.com/store/apps/details?id=com.truckdues

The mobile application has been developed to be user friendly with the simplest of interfaces available for easy navigation. This application enables you to file your tax returns on the go with just a click of a button and allows you to download the schedule-1 copy directly from your account without toggling between your email and the website. Hope this application helps you to file your taxes with ease and we are always open for suggestions. Any improvements to be done or features to be added will be heard and timely updates will be provided for hassle free user experience. Download the App now and start filing your 2290 taxes today.

And as we always remind you, time is up for filing your prorated from 2290 taxes for vehicles purchased in the month of March, so you know what to do, download the app and start filing or just give us a call at 347-515-2290 for phone assistance. You may also contact us through chat or just drop an email to support@truckdues.com Our tax experts are available at your disposal. Its once again bye from the TruckDues team until next time with a timely update on your Form 2290’s.

Stay safe!