For truckers and trucking taxpayers, reporting Form 2290 HVUT reports feels like driving through a blizzard, confusing and frustrating. But they must endure this hardship every season to carry out their trucking operations without delay. But there is a beacon of hope to navigate through every tax season seamlessly, e-filing Form 2290 online. TruckDues.com is an IRS–approved Form 2290 modernized e-filing service provider where truckers and trucking taxpayers report and pay their taxes online, making their lives much easier.

Tag Archives: Truck Tax

Save Big on Form 2290 E-file Charges This Black Friday!

Become a member of the TruckDues.com family and start saving big from this upcoming season. Greeting truckers! TruckDues.com welcomes you to register for free and e-file Form 2290 at the most affordable cost for a lifetime. This Black Friday! Don’t miss out on a chance that will make filing your Form 2290 an effortless and cost-effective process.

Pro-rated Form 2290 Taxes for April Used Vehicles are Due Soon!

Dear truckers! TruckDues.com is taking this opportunity to remind you that form 2290 truck taxes for April 2023 used trucks are due on a pro-rated basis. The last date to report the pro-rated truck taxes for April used heavy vehicles, and trucks is May 31, 2023. Therefore, truckers with heavy vehicles or trucks first used in April must report form 2290 and get the valid Schedule 1 receipt to continue their trucking operations on the public highways. And TruckDues.com is the right place for you to report form 2290 pro-rated taxes and get the IRS Schedule 1 receipt on time. Register for free on TruckDues.com and stay ahead of the deadline today!

Form 2290 Pro-rated Taxes for March Used Trucks are Due in a Few Days!

Dear Truckers! TruckDues.com is an IRS – approved modernized form 2290 online e-filing service provider serving truckers to report their truck taxes online effectively. We would like you to remind our trucking community that the last date to report form 2290 pro-rated taxes for the trucks first used on March 2023 is due by May 01, 2023. As the due date is just around the corner, you must e-file pro-rated form 2290 truck taxes on TruckDues.com and stay ahead of this month’s deadline.

TruckDues.com is now open for Pre-filing of form 2290 for the upcoming TY 2022-2023!

A huge shout out to the truckers and trucking taxpayers! The new tax year is just around the corner. You have to start preparing the truck tax reports and file them when the IRS starts accepting the HVUT form 2290 for the new tax year. IRS accepts new form 2290 only at the beginning of the tax season, which will be sometime around the first week of July 2022. Therefore, the IRS will be crowded with truckers and taxpayers looking to report their form 2290 for the TY 2022-2023 and get their respective schedule 1 copies to continue their trucking operation on the public highways. E-filing method will also be somewhat crowded because IRS takes some time longer than usual to process the online form 2290 tax reports due to jammed form 2290 reports. To overcome this situation, TruckDues.com introduced the form 2290 pre-filing method, which allows you to e-file form 2290 with us ahead of the tax season. We will hold it on your behalf and send it to the IRS when the tax season begins. Your form 2290 reports will be among the first to reach the IRS for processing, and you will get the form 2290 schedule 1 copy at the beginning of the tax season itself.

To All the Trucking Dad’s out there , Happy Fathers day !

The quality of a father is seen by his goals, dreams and aspirations that he sets, not for himself but for his family by mentoring them towards success and Every great achiever is inspired by a mentor and that would definitely be a father. Any man can become a father but it takes something special to become a dad. To all the “Something Special” throughout the globe we say our happiest father’s day to you.

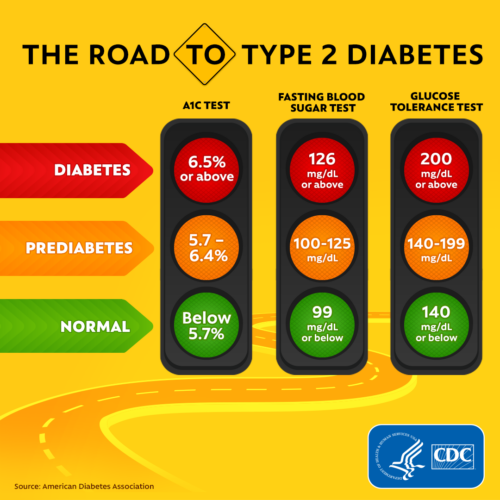

Continue readingDid you know a soda a day can increase your risk of diabetes up to 25%!?

Could you be one of the 38 million American adults with diabetes or 88 million Americans that are pre-diabetic and not know it? This month is American Diabetes Month, and we want to shine a spotlight on what has become one of the fastest growing health epidemics in the United States. It is also one of the three top diagnosis St. Christopher Fund sees from truck drivers that apply for assistance. Statistics show that the number of people diagnosed with diabetes has grown 700% in the last 50 years! Coincidentally, the cost of insulin has risen 1,700% since 1970.

Continue readingTruckdues.com is open for business despite the COVID-19 situation

TruckDues.com is closely monitoring the COVID-19 pandemic. We value the trust you place in us and our team for your 2290 Electronic Filing service.

We understand the importance of your business and are working persistently in effort to minimize disruptions associated with COVID-19. You can completely rely on us for your 2290 tax reporting as we have taken adequate steps to support you and your business with 2290 efiling.

We have a comprehensive business continuity plan in place for natural disasters that has been adjusted to also cover a pandemic. We anticipate being able to service the needs of our customers, you can be confident that we are well equipped and prepared to aid you if you experience any challenges with 2290 electronic filing. You can continuously reach us at 347 – 515 – 2290 or write to us at support@truckdues.com.

Our thoughts are with our colleagues, customers and truckers who are working tirelessly to overcome the unique challenges brought on by this exceptional situation.

Please follow the guidelines issued by the CDC and Stay Safe.

2290 eFile is Rewarding with TruckDues

The Federal Vehicle Use Tax Form 2290 for the tax year 2019 – 2020 was due on September 3rd. If you have missed it out on your heavy highway vehicle that was first used on July don’t delay further as you’re increasing your penalty and late filings charges every day. If you’re vehicle was first used in August and you’re prorating your taxes for the left out months and September 30 is the last date to report it with the IRS. You’ve taken the right decision to eFile your 2290s and you’re at the right place, Yes TruckDues helping 1000s of truckers to get it online and IRS watermarked Schedule 1 receipt in just minutes.

With 2290 eFiling you’re going to get rewarded with the economic fee, save time, convenient filing and payment options. IRS payment can either be paid from your bank account automatically or using your Credit Card or Debit Card and by using EFTPS portal or Check and Money Order.

Continue readingRed is Victory, White is for Purity, Blue is for Loyalty. Happy Birthday USA!

Freedom is nothing but a chance to be better. 4th Of July is an important day for the residents of the United States as our country became free and declared its independence on this special day. This independence was first enjoyed in the year 1776 and could be possible only by the efforts made by the leaders and the great personalities. Their efforts as well as sacrifices finally broke the chains to become a free nation. Continue reading

Freedom is nothing but a chance to be better. 4th Of July is an important day for the residents of the United States as our country became free and declared its independence on this special day. This independence was first enjoyed in the year 1776 and could be possible only by the efforts made by the leaders and the great personalities. Their efforts as well as sacrifices finally broke the chains to become a free nation. Continue reading