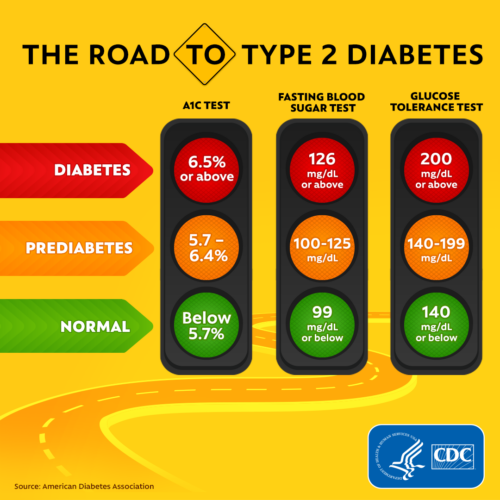

Could you be one of the 38 million American adults with diabetes or 88 million Americans that are pre-diabetic and not know it? This month is American Diabetes Month, and we want to shine a spotlight on what has become one of the fastest growing health epidemics in the United States. It is also one of the three top diagnosis St. Christopher Fund sees from truck drivers that apply for assistance. Statistics show that the number of people diagnosed with diabetes has grown 700% in the last 50 years! Coincidentally, the cost of insulin has risen 1,700% since 1970.

Continue reading