Hello there Truckers, This article is also a reminder about the Pro-Rated HVUT Form 2290 for vehicles first used since February 2019. The Federal law indicates that the Form 2290 must be e-filed by the last day of the month following the month of its first use. On that basis, the Form 2290 is now due for vehicles first used since February 2019.

The HVUT form 2290 is basically an annual tax paid to the Internal Revenue Service for vehicles that are used over the public highways and if the subjected vehicle’s gross weight is at least 55000 lbs or more. This tax Form is basically due by June and its payable until the end of August. (The current tax year is for the period beginning July 1, 2018 through June 30, 2019) and the due date for e-filing the Annual Form 2290 is basically August, 31st.

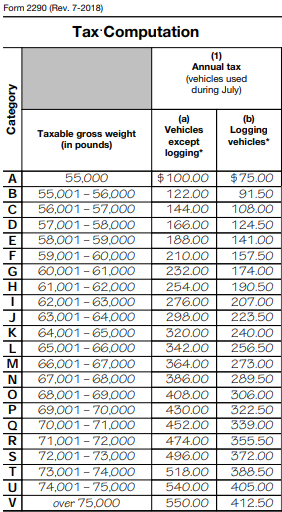

The Form 2290 tax due is basically determined by the gross weight of the Truck and if the truck seems to exceed the desired mileage limit for exemption. This is drafted by the internal Revenue Service to be 5000 miles (For commercial based units & 7500 miles for Agricultural based vehicles). If the subjected vehicles seems to exceed the desired mileage for exemption, the taxes always needs to be paid full in advance to the IRS for the respective period it’s been reported.

E-Filing Form 2290 has been made easy using www.truckdues.com, The IRS digital watermarked copy of Schedule 1 will be emailed to you within minutes after you e-file. Economic E-Filing begins here as low as $7.99.

Reach us back for any further assistance over the following mediums:

Phone: (347) 515-2290 [Monday through Friday, 9 A.M to 5 P.M, Central Standard Time]

E-mail: support@truckdues.com

Live chat with our tax representatives.

Have a Good One! See you over the next article.