Dear Truckers and Trucking Taxpayers! TruckDues.com has successfully completed another form 2290 tax filing season, and we hope all of you have reported the HVUT form 2290 to the IRS successfully. This message is for the truckers and taxpayers who missed the deadline and have not yet filed the form 2290 truck tax returns, as we all know that submitting the tax reports to the IRS and getting the stamped schedule 1 receipt is essential to operate the trucking business. Therefore, we request the truckers who didn’t file the 2290 reports to e-file form 2290 at TruckDues.com immediately and get the IRS digitally stamped schedule 1 receipt.

Tag Archives: form 2290 truck tax

FREE VIN CORRECTION, only at TruckDues.com! Revise your schedule 1 copy today!

Dear truckers! Truckdues.com thanks you again for making this form 2290 tax filing season an incredible success. We hope you have successfully filed your form 2290 truck tax reports and paid your tax dues to the IRS. If you entered the incorrect VIN of your heavy vehicle while e-filing form 2290 HVUT at TruckDues.com and got your schedule 1 receipt from the IRS, you don’t have to worry about this. TruckDues.com offers a free VIN correction service where you can apply for VIN correction online, absolutely free of cost. You can e-file for form 2290 VIN corrections at TruckDues.com and get the revised schedule 1 receipt to your email within a few minutes.

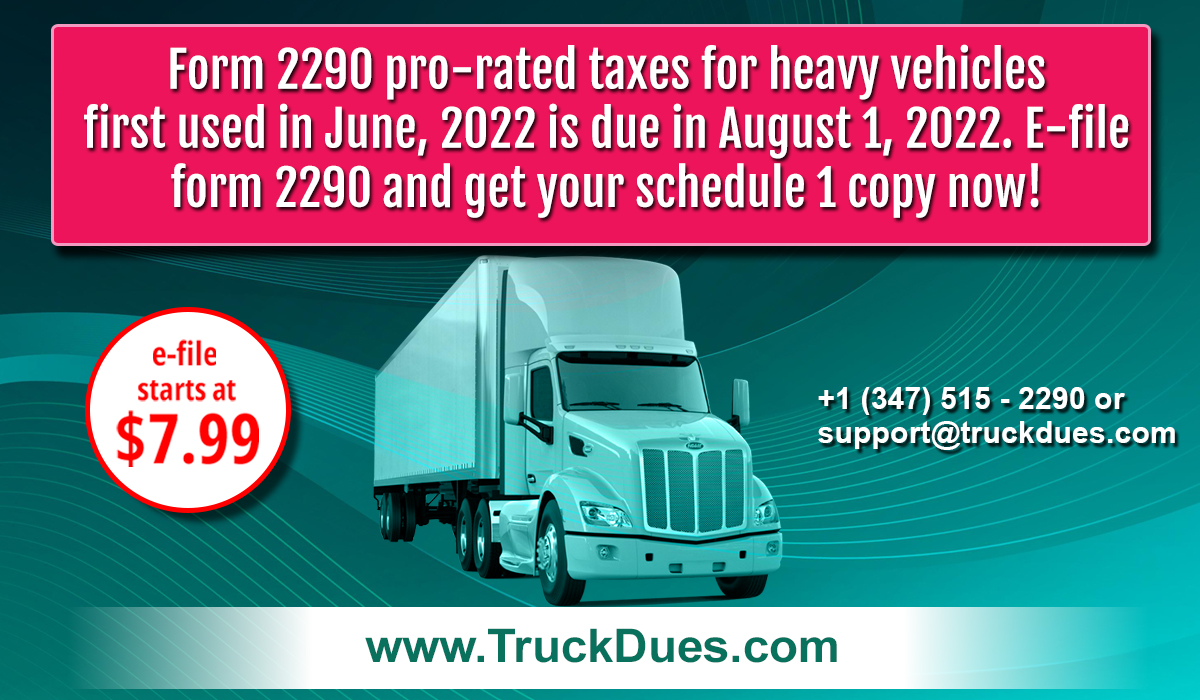

Form 2290 pro-rated taxes for heavy vehicles first used in June 2022 is due on August 1, 2022.

Hello truckers, we know that you are busy filing the form 2290 truck tax reports for the new tax period, TY 2022-2023, or you have already done your form 2290 e-filing online for the new tax period at TruckDues.com. But this is a gentle reminder for the truckers with their heavy vehicles first used in June 2022. Form 2290 truck tax for the vehicles first used in June is due on August 1, 2022. So, the truckers should e-file form 2290 within the deadline and get the schedule 1 copy to continue their truck operations on the public highways.

Form 2290 E-filing is actively happening at TruckDues.com! E-file your truck taxes today!

Hello, truckers! The new tax season, 2022-2023, has started, and truckers are filing their form 2290 truck tax reports to the IRS. The deadline to complete filing your 2290 truck tax returns to the IRS is August 31, 2022. So, we request the truckers not to wait until the due date to file your form 2290 truck taxes. E-file it at TruckDues.com and get the IRS official schedule 1 copy today.

Anyone can e-file form 2290 truck taxes at TruckDues.com!

Hello, truckers and truck taxpayers! The new tax season, TY 2022-2023, is upon us, and the IRS is receiving the HVUT form 2290 for this new tax year. Therefore, you must file your truck tax reports and get the schedule 1 copy before the deadline to stay out of penalties and late charges from the IRS. The last date to file your form 2290 truck tax returns to the IRS and get the official schedule 1 copy is August 31, 2022, for this tax season.

IRS made electronic filing mandatory for the truckers with 25 heavy vehicles and more. Also, they encourage the truckers with even a single vehicle to e-file form 2290 online because it is accurate and easy to process for the IRS, and they can issue the schedule 1 copy in just a few minutes.