Hello, truckers! This is a gentle reminder to inform you that the pro-rated form 2290 tax for the heavy vehicles first used on April 2022 is due on May 31, 2022. So, all truckers and truck taxpayers with the trucks first used in April should file their form 2290 HVUT to the IRS and get the official schedule 1 copy within the last date. Or else, the IRS will charge penalties or late fees based on the tax amount, and it will become impossible to operate your heavy vehicle on the public highways without a valid schedule 1 copy.

Tag Archives: FORM 2290 ONLINE FILING

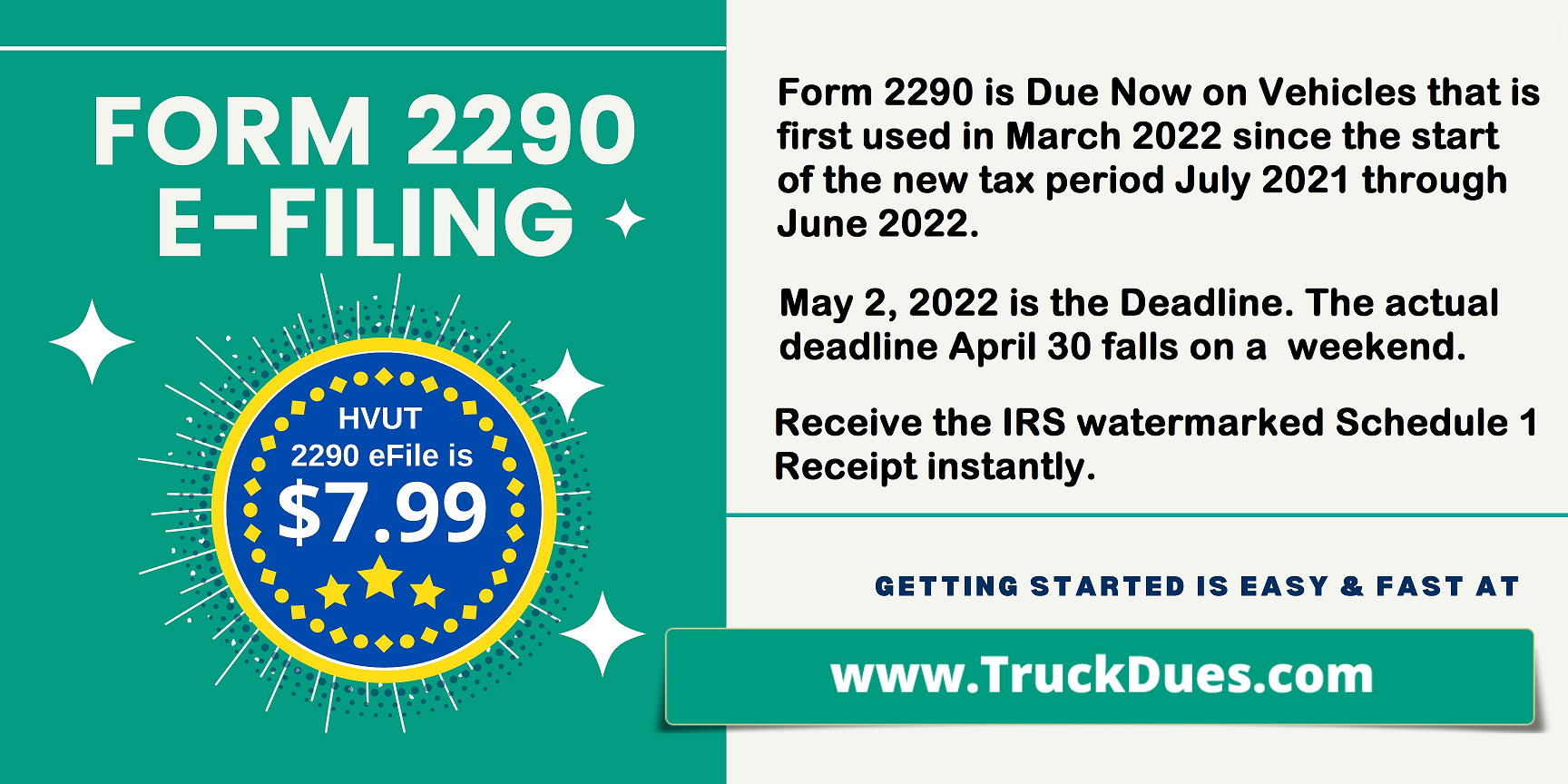

Form 2290 Partial Period Tax on Heavy Highway Vehicles used in March 2022 is Due Soon!

The heavy highway vehicle use tax, HVUT form 2290, is due for the trucks that are first used or newly purchased in March 2022 and is due at May 2nd 2022. So, the truckers who own or operate the vehicles first used on March 2022 should know that they should report and pay their form 2290 truck tax to the IRS within the last date.

Pro-rated or Partial Period Form 2290 Truck Tax.

Corrections are possible while e-filing your HVUT Form 2290!

Hello there truckers, over this article we are now going to discuss about the advantages f e-filing your HVUT Form 2290. Most of you all know that Form 2290 was basically mailed by paper and anticipate a response back from the Internal Revenue Service in a delayed fashion. However this was only until e-filing could emerge as the revolutionary way of easing up processing of reporting and filing your HVUT tax Form 2290 to the Internal Revenue Service. Continue reading

Hello there truckers, over this article we are now going to discuss about the advantages f e-filing your HVUT Form 2290. Most of you all know that Form 2290 was basically mailed by paper and anticipate a response back from the Internal Revenue Service in a delayed fashion. However this was only until e-filing could emerge as the revolutionary way of easing up processing of reporting and filing your HVUT tax Form 2290 to the Internal Revenue Service. Continue reading