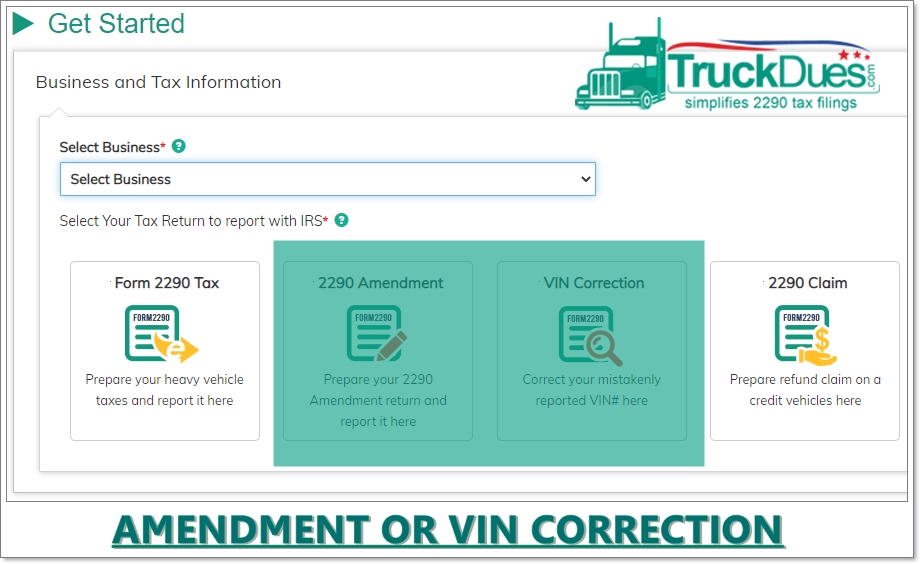

Hello there truckers, over this article we are going to discuss on how to go about reporting an increase in the Gross weight of your truck. We on daily basis receive calls from our clients required to file an amended 2290. Often customers confuse between VIN correction and amendments. If you have done a mistake on the VIN numbers you have to do a VIN correction, If you have to correct the mistake occurred on their taxable gross weight of the vehicle that’s when you do an amendment. Now refers to this article to get a clear picture on this scenario.

Basically the Form 2290 is known to be the Heavy Highway vehicle used tax return which is filed on vehicles which possess a minimum gross weight of 55000 lbs or more and if the same truck is been used over the public highway for commercial purposes.

Having said that 55,000 is the minimum weight required to be able to qualify for a Heavy Vehicle however it must not be assumed to the maximum weight of a truck, Heavy trucks tonnage index refers to weights over a 100,000 lbs easy. So, when there is a requirement for a change of the gross weight of the vehicle, all you need is an amended 2290 Form.

By filing an amendment you’d only make the difference in the tax due payment in accordance to the increase in the gross weight in lbs. As there is a $22 increase versus an increase of every 1000 lbs. By filing the amended Form 2290, you would receive a new copy of schedule 1 with a digital watermarked indicating e-filed with the date stamp.

And just a reminder if you had brought a new truck in the month of January you truck taxes is due by March 01 2021. E-File your HVUT Form 2290 via www.truckdues.com to receive the IRS digital watermarked copy of schedule 1 back in your e-mail within minutes after you e-file. Reach us back for any further assistance over the following mediums:

Phone: (347) 515-2290 [Monday through Friday, 9 A.M to 5.30 P.M, Central Standard Time]

E-mail: support@truckdues.com

Live chat with our tax representatives.