Hello Truckers! Today we are going to discuss the possible reasons behind the rejection of your tax returns. Before you begin e-filing your Heavy Highway Vehicle Used Taxes online make sure that you provide no incorrect information during the time of filing as it would be summarily rejected by the Internal Revenue Service (IRS). Hence, it would cost your time to figure out what could be the way to fix your return. So just spare few minutes reading this article to know what they are:

“Filer’s EIN and Name Control in the Return Header must match data in the e-File database, unless “Name Change” or “Name or Address Change” checkbox is checked, if applicable... “

This above error message means that your return could have been rejected by the Internal Revenue Service for 3 possible reasons: They are

- The IRS has found that either your Business name or the Employer Identification Number doesn’t match as per their database.

- The Employer Identification Number must have been applied or obtained within the last 15 Business days which is meant to be too early to use; As the IRS takes up to 15 business days to record your electronic EIN application.

- Usage of SSN over EIN: The IRS mandates tax payers to use a valid Employer Identification Number (Refer Point 2). You can’t use your SSN in place of the EIN. As the IRS would reject your application online in case of using your SSN.

“Routing Transit Number (RTN) must confirm to the banking industry RTN algorithm.”

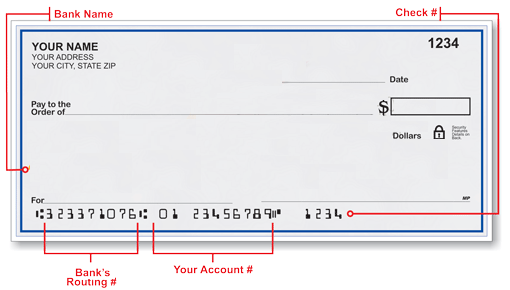

This error message occurs when you have preferred to make your tax payment to the IRS via Checking or Savings account which involves entering your Bank Account Number & the Routing Transit Number for the IRS tax deduction.

Many a tax payer finds hard to locate the RTN on the check, which ends up in getting the Account & the RTN transposed over the tax return, hence results in denial of their application by the Internal Revenue Service.

The Routing Transit Number is a nine digit code, which appears on the bottom of negotiable instruments such as checks to identify the financial institution on which it was drawn.

“ Submission must not be a duplicate of a previously accepted submission. Duplicated Submission.”

While e-filing your 2290, you must make sure the year for which the tax return is been filed for. The IRS doesn’t allow you to report your vehicle twice over the Form 2290 within one tax year (July through June). Intending to report would be denied by the IRS for duplication of vehicle information & to prevent you making an over payment of taxes.

Needless to Say, Should you have any inquiries or doubts or to seek more information on your filing, Feel free to reach our customer support team @ (347) 515-2290 or e-mail us at support@truckdues.com.