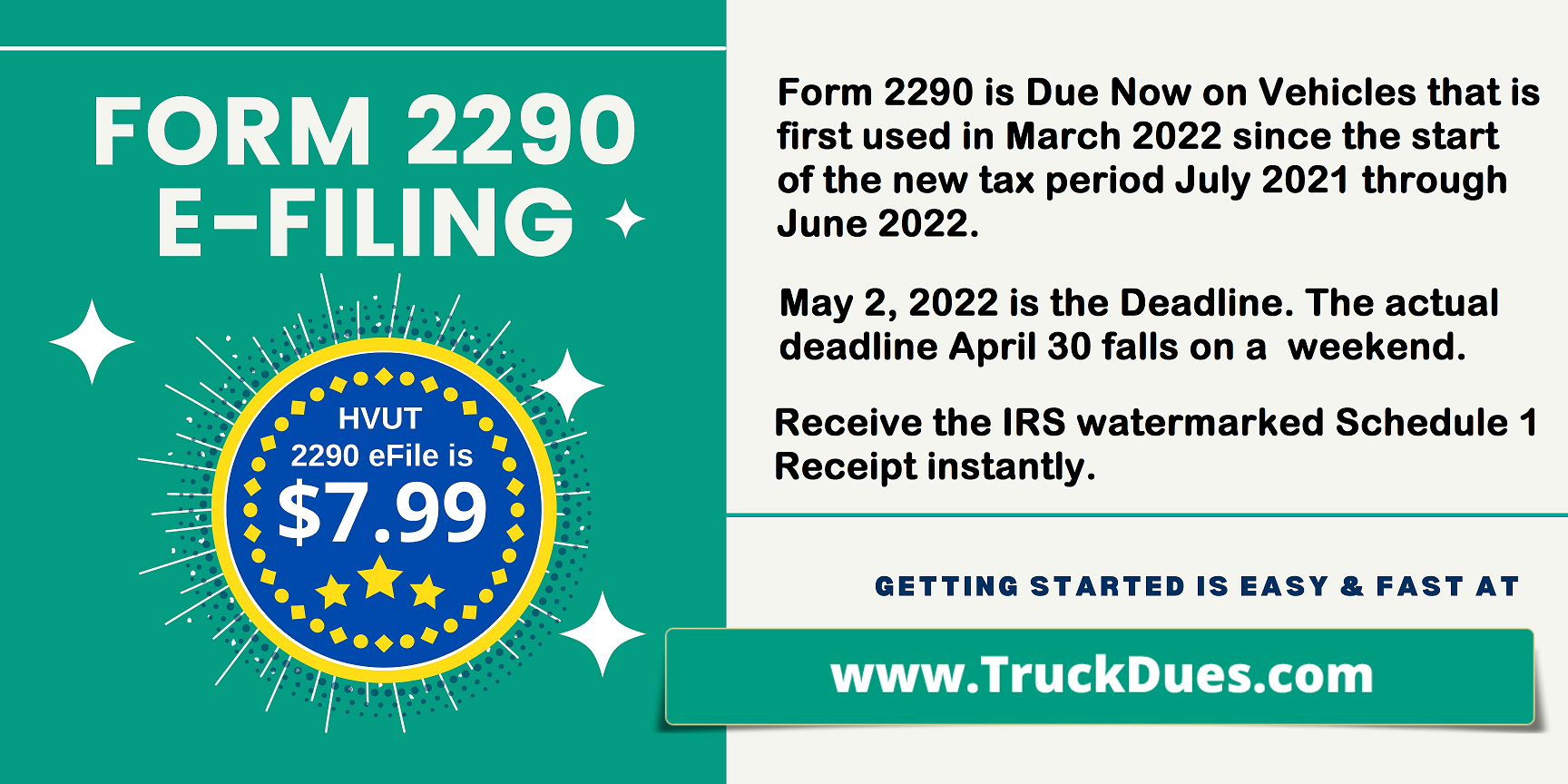

The heavy highway vehicle use tax, HVUT form 2290, is due for the trucks that are first used or newly purchased in March 2022 and is due at May 2nd 2022. So, the truckers who own or operate the vehicles first used on March 2022 should know that they should report and pay their form 2290 truck tax to the IRS within the last date.

Pro-rated or Partial Period Form 2290 Truck Tax.

Heavy vehicle truckers with taxable vehicles should pay the form 2290 during the tax period, which starts in July and lasts until June 30th of the following year. So, this July to next June is considered the usual tax period for the form 2290 heavy use truck taxes. And the IRS accepts the form 2290 payments and reports from July 1st every year. The truckers have till the end of August (August 31st) to pay and report their form 2290 truck taxes to the IRS and get their schedule 1 copy to smoothly operate their trucks on the public highways of the United States.

But for the vehicle that operates or is newly purchased on any other month than July, the IRS charges the taxes on a pro-rated basis based on the first used month of that particular vehicle. Since your first used month is March, your taxes are calculated on a pro-rated basis from the month of March to June, which is the end of the general tax year. You should calculate accordingly and pay your tax amount to the IRS on or before May 2nd 2022 using the HVUT form 2290.

You need to pay the taxes only for the taxable vehicle.

Even though you operate a heavy vehicle or a truck, you only need to pay the highway use tax if your vehicle falls under the taxable category. The vehicle needs to have a taxable gross weight of over 55,000 pounds and is estimated to run more than 5,000 miles (7500 for logging vehicles) on the public highways comes under the taxable vehicle. For the taxable vehicle, you need to estimate and pay the tax amount in full before you start to operate on the public highways.

If your vehicle doesn’t fall under the taxable category, you have to still file form 2290 and report to your vehicle to the IRS as a tax suspended vehicle. You just need to report form 2290, you don’t have to pay any taxes to the IRS.

E-file form 2290 on a pro-rated basis at TruckDues.com now!

You don’t have to the IRS office and wait in line to file your taxes. Again, wait for a few weeks to get your schedule 1 copy from the IRS through the mail. You can e-file your HVUT truck taxes on truckdues.com and get the official IRS stamped/water-marked schedule 1 to your mail within a few minutes of the approval. You can complete the entire form 2290 e-file online process within thirty minutes and get the schedule 1 copy. E-filing form 2290 at truckdues.com is the most secure and easiest way to report and pay your form 2290 truck taxes online directly to the IRS. You can print the IRS schedule 1 copy from your email and use it for legal purposes like registration, DMV, insurance, etc.

Form 2290 e-filing starts at $7.99 at truckdues.com. E-file and get your schedule 1 copy now!