Hello there

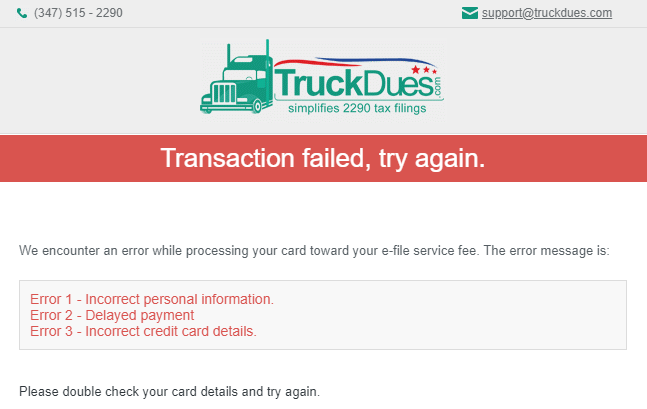

Truckers, over this article we are going to discuss about the most common

trouble faced by our users while trying to process the service fee payment

using their credit/debit cards towards electronically transmitting their tax

returns to the IRS for acceptance.

When you

generally try to use your credit/debit card over any website to conduct a

transaction, you could possibly face a transaction failure message due to these

3 common errors as listed below:

Error 1 –

Incorrect personal information.

Error 2 – Delayed

payment

Error 3 –

Incorrect credit card details.

Incorrect personal information:

The term

speaks for itself, when your information entered likely Name on the card, the

Billing address etc. seems to be imprecise in accordance to the card you’re

trying to use, basically it ends up as a failure in authenticity of the

transaction, and hence our system will not be able to capture/process the

payment off your card. Hence, it’s better to verify your personal information

before processing a payment.

Delayed payment:

A stable

internet connection is absolutely necessary for a transaction to go through

successfully. If the internet speed fluctuates heavily then it could affect the

transaction. Also, closing the tab or window will result in failed payment or

incomplete payment. Also, letting the webpage to remain stranded for a longer with

no activity might expel you off the current session and would advise you to re-login

to re-establish connection. That being said, this remains to be another reason

to face a Transaction Failure.

Incorrect credit card details.

If your

transaction is unsuccessful, it’s because your bank or Credit Card Company has

declined the transaction due to entry of incorrect details. Possible reasons

why your payment was declined: your type of card is not accepted by this

website like if you forget to select the type of the card such as VISA, MASTER,

AMERICAN EXPRESS, DISCOVER etc. before entering your card details.

Now

regardless of the above 3 error scenarios, if you faced a transaction failure

& if your bank account indicates withdrawals, do not panic as the failure payments does appear to be a debit on your statement

but technically the money was unsettled to us on these failure transactions.

Well, generally your financial institution/Bank reserves the

amount for every transaction that you attempt to conduct. However if the

transaction fails your bank will automatically release the funds back to your

bank account. Generally it takes up to 2-4

business days (depends on your financial institution’s terms & regulations)

to notice the credit appearance in your card. You may certainly contact your

bank for further inquiries over this matter.

We hope you

find this article useful while performing any credit card transactions

henceforth.

Reach us back for any further assistance over the following

mediums:

Phone: (347) 515-2290 [Monday

through Friday, 9 A.M to 5 P.M, Central Standard Time]

E-mail: support@truckdues.com

Live chat with our tax representatives.

Have a Good One! See you over the next article.