Hello, truckers! Now that the seasonal surge has come to an end, you can e-file for other Form 2290 processes like VIN correction, Form 2290 amendments, and Form 8849 Schedule 6 refund claims. You can now claim truck tax refunds for previously paid tax returns using Form 8849 Schedule 6 on TruckDues.com. We provide a convenient online platform to report your refund claims directly to the IRS and get everything sorted within no time. Also, remember that you can apply for refunds for taxes paid during this tax season only during the following tax seasons. You must apply for tax refunds within three years of original tax payments. Otherwise, your tax refund application will be considered invalid per the IRS regulations.

Tag Archives: Form 2290 VIN correction

Access the FREE VIN Correction Services on TruckDues.com now!

Hello, truckers! We sincerely hope you had a wonderful online Form 2290 truck tax filing season with TruckDues.com and successfully got your IRS digitally watermarked Schedule 1 receipt. If you received your Schedule 1 receipt with an incorrect VIN of your truck, you must correct it immediately. To do that, you can e-file Form 2290 VIN correction on TruckDues.com for free of cost and get the Schedule 1 receipt with the corrected VIN of your truck to your registered email address.

TruckDues.com Thanks our Truckers for Driving Us into Another Successful Season!

We want to take this moment to thank you all for making the tax filing period of this season a monumental success. We are delighted to announce that we recorded the highest Form 2290 tax e-filing for TruckDues.com in this period. Again, we thank you for your contribution and for choosing us as your constant Form 2290 e-filing service partner. Also, many new truckers and trucking taxpayers have joined our family and successfully e-filed Form 2290 tax reports for this season. We sincerely hope you had an amazing experience on our platform and will continue your Form 2290 tax filing journey.

Let Us Understand the Difference Between Logging and Agricultural Vehicles in Form 2290 HVUT!

Hello, truckers! Apart from the heavy commercial vehicles, logging and agricultural vehicles used for their specific purposes are entitled to form 2290 truck taxes. But taxes are charged specially for these two vehicle categories. Therefore, truckers having logging or agricultural vehicles must understand how these vehicles are taxed under form 2290 and report the taxes accordingly. Let us look into both vehicles separately and the special under which they are taxed in form 2290 HVUT.

FREE VIN CORRECTION, only at TruckDues.com! Revise your schedule 1 copy today!

Dear truckers! Truckdues.com thanks you again for making this form 2290 tax filing season an incredible success. We hope you have successfully filed your form 2290 truck tax reports and paid your tax dues to the IRS. If you entered the incorrect VIN of your heavy vehicle while e-filing form 2290 HVUT at TruckDues.com and got your schedule 1 receipt from the IRS, you don’t have to worry about this. TruckDues.com offers a free VIN correction service where you can apply for VIN correction online, absolutely free of cost. You can e-file for form 2290 VIN corrections at TruckDues.com and get the revised schedule 1 receipt to your email within a few minutes.

Just four days remain before the April 30th deadline for submitting Form 2290 for vehicles first used since March 2021. E-file Now!

Good day, truckers! We’ve got an important update for you. For any new vehicles first used on a public highway in March, the Heavy Highway vehicle used tax return is due on a pro-rated basis for the period July 1, 2020, to June 30, 2021, and is due on April 30, 2021.

E-filing allows for a quicker approval of the tax return. It’s best to E-File your HVUT Form 2290 as soon as possible to prevent a last-minute panic that might result in your vehicle registration being revoked. Many last-minute 2290 e-filers have been advised that they will be unable to earn income so failure to file this form prevents you from using your vehicle on the road to support the needs of the people.

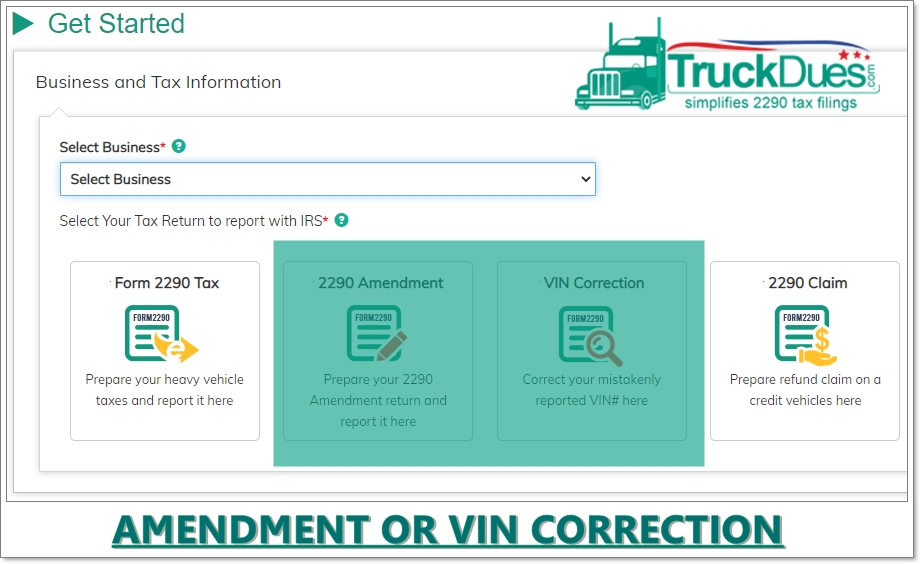

Continue readingAmendment or VIN correction? Here’s what you need to know

Hello there truckers, over this article we are going to discuss on how to go about reporting an increase in the Gross weight of your truck. We on daily basis receive calls from our clients required to file an amended 2290. Often customers confuse between VIN correction and amendments. If you have done a mistake on the VIN numbers you have to do a VIN correction, If you have to correct the mistake occurred on their taxable gross weight of the vehicle that’s when you do an amendment. Now refers to this article to get a clear picture on this scenario.

Basically the Form 2290 is known to be the Heavy Highway vehicle used tax return which is filed on vehicles which possess a minimum gross weight of 55000 lbs or more and if the same truck is been used over the public highway for commercial purposes.

Continue readingCorrecting errors on the VIN has been made easy with Truckdues.com!

Did you ever encounter the moment when, just after it’s too late to do anything about it, you realize you messed something up? It’s always nice to know that you can go back and correct an error when you find one. In this article we are going to discuss on how to go about correcting an incorrect VIN that was accidentally reported over a Form 2290. Continue reading

Did you ever encounter the moment when, just after it’s too late to do anything about it, you realize you messed something up? It’s always nice to know that you can go back and correct an error when you find one. In this article we are going to discuss on how to go about correcting an incorrect VIN that was accidentally reported over a Form 2290. Continue reading