Hello, truckers! Now that the seasonal surge has come to an end, you can e-file for other Form 2290 processes like VIN correction, Form 2290 amendments, and Form 8849 Schedule 6 refund claims. You can now claim truck tax refunds for previously paid tax returns using Form 8849 Schedule 6 on TruckDues.com. We provide a convenient online platform to report your refund claims directly to the IRS and get everything sorted within no time. Also, remember that you can apply for refunds for taxes paid during this tax season only during the following tax seasons. You must apply for tax refunds within three years of original tax payments. Otherwise, your tax refund application will be considered invalid per the IRS regulations.

Tag Archives: Form 2290 amendments

Access the FREE VIN Correction Services on TruckDues.com now!

Hello, truckers! We sincerely hope you had a wonderful online Form 2290 truck tax filing season with TruckDues.com and successfully got your IRS digitally watermarked Schedule 1 receipt. If you received your Schedule 1 receipt with an incorrect VIN of your truck, you must correct it immediately. To do that, you can e-file Form 2290 VIN correction on TruckDues.com for free of cost and get the Schedule 1 receipt with the corrected VIN of your truck to your registered email address.

TruckDues.com Thanks our Truckers for Driving Us into Another Successful Season!

We want to take this moment to thank you all for making the tax filing period of this season a monumental success. We are delighted to announce that we recorded the highest Form 2290 tax e-filing for TruckDues.com in this period. Again, we thank you for your contribution and for choosing us as your constant Form 2290 e-filing service partner. Also, many new truckers and trucking taxpayers have joined our family and successfully e-filed Form 2290 tax reports for this season. We sincerely hope you had an amazing experience on our platform and will continue your Form 2290 tax filing journey.

E-file Form 2290 Truck Taxes on TruckDues.com This Tax Season.

Hello, truckers! IRS made e-filing mandatory for truckers and trucking taxpayers reporting truck taxes for 25 or more vehicles at a time. Form 2290 electronic filing is simple, accurate, and easy for the IRS to process tax returns. Since every process in the e-filing method is automatic, tax filers and IRS can be free of human errors and speed up the entire tax process. Through the Form 2290 e-filing method, IRS can process the 2290 returns and instantly send the IRS digitally stamped Schedule 1 receipt to the taxpayers’ email. Taxpayers and IRS can save time and money through Form 2290 online e-filing. Therefore, the IRS encourages truckers reporting even for a single vehicle to prefer the e-filing method and e-file Form 2290 through authorized online e-filing service providers.

Let Us Understand the Difference Between Logging and Agricultural Vehicles in Form 2290 HVUT!

Hello, truckers! Apart from the heavy commercial vehicles, logging and agricultural vehicles used for their specific purposes are entitled to form 2290 truck taxes. But taxes are charged specially for these two vehicle categories. Therefore, truckers having logging or agricultural vehicles must understand how these vehicles are taxed under form 2290 and report the taxes accordingly. Let us look into both vehicles separately and the special under which they are taxed in form 2290 HVUT.

IRS is accepting form 2290; E-file your 2290 truck taxes before the deadline.

Shout out to all truckers and trucking taxpayers! IRS is live and processing form 2290 tax reports. So, hurry up and e-file form 2290 HVUT for your December used heavy vehicles. E-file form 2290 online at TruckDues.com to get the instant schedule 1 receipt and continue your trucking business smoothly. The last date to e-file form 2290 HVUT for your December used heavy vehicles or trucks on a pro-rated basis is January 31, 2023. Therefore, truckers and trucking taxpayers must ensure that they report and pay form 2290 truck taxes to the IRS and get the IRS stamped schedule 1 copy on or before the deadline.

TruckDues.com wishes you a very Happy Christmas 2022!

Dear truckers! We wish you Merry Christmas and a Happy New Year 2023! May this holiday season shine us joy and positivity. TruckDues.com takes this moment to thank you for another fantastic year and choosing our platform as your form 2290 HVUT e-filing service platform. We offer effective and efficient form 2290 online e-filing services to all truckers and trucking taxpayers.

Enjoy the great customer experience at TruckDues.com to complete 2290 taxes online.

Hey there, wonderful truckers! IRS encourages all the truckers to e-file form 2290 online. And to make the process even easier, IRS delegated the e-filing service to the technical experts as its authorized modern e-file service providers. Truckdues.com is an IRS-approved modernized e-file service provider of form 2290 HVUT online. Truckdues got all the technical and security clearance from the IRS as per the rules and regulations to facilitate smooth e-filing of form 2290 between the taxpayers and the IRS.

Truckdues.com is the best e-file service provider for all American truckers. We offer a simple online platform and mobile applications for both Android and iOS users. So, you can use TruckDues on your personal computer, tablet, or smartphone at your convenience from the comfort of your home or office. Continue reading

Form 2290 electronic filing at truckdues.com saves time and money. How?

Hello truckers, IRS made electronic filing mandatory for filing form 2290 truck tax returns for all the truckers with 25 and more heavy motor vehicles in their fleet. Also, they encourage other truckers to e-file form 2290 online, even for single-vehicle tax returns. IRS now prefers e-filing form 2290 and doing everything digitally because it is easy, convenient, avoids human-to-human contact in these pandemic times. Along with that, e-filing significantly reduces man made errors, and record-keeping is very easy to maintain for the IRS.?

Now let us see how the form 2290 electronic filing benefits the truckers by saving time and money!? most importantly the IRS Watermarked Schedule 1 receipt proof is shared with you instantly.  Continue reading

Continue reading

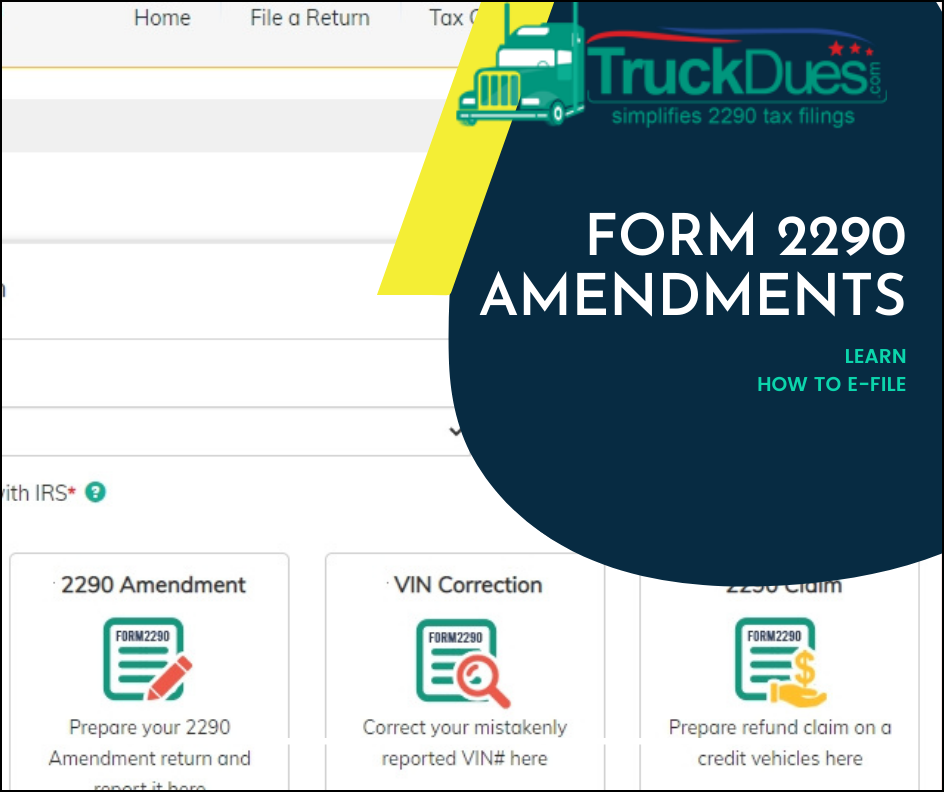

Why do we go for a 2290 Amendment?

Hey truckers it’s once again time for a few pointers and transfer of knowledge about your HVUT Form 2290 filings. The filing season was a hectic one, wasn’t it? Since you are done with filing the returns hope you checked your schedule-1 copies for any mistakes. Any mismatch in the information would end up as a void filing. The recent question which we faced was about “2290 AMENDMENTS”. In this blog, we are going to see when to file an amendment and how to and when not to.

An Amendment is bringing about a change or correction to an existing return. People often confuse between VIN correction and an amendment. The VIN correction needs to be done on a separate filing and this doesn’t relate to anything with the Amendments.

Amendments are basically for reporting two things

- When there is an increase in gross weight (truck, trailer, and max load capacity)

- When the suspended vehicle exceeds the mileage limit (over 5000 miles)