Hey there truckers, we hope this article reaches you in high spirits. We’re sure that you know almost everything about a HVUT Form 2290. Although, we also feel that you must know about the Form 8849 Schedule 6 (Claim for Refund of Excise Taxes) to claim refunds on a vehicle that was earlier reported on a Form 2290. Continue reading

Hey there truckers, we hope this article reaches you in high spirits. We’re sure that you know almost everything about a HVUT Form 2290. Although, we also feel that you must know about the Form 8849 Schedule 6 (Claim for Refund of Excise Taxes) to claim refunds on a vehicle that was earlier reported on a Form 2290. Continue reading

Tag Archives: Form 2290 Amendment

There is no option in Form 2290 to extend the Deadline like Form 1040 does!

Hey there truckers, we hope this article reaches you in high spirits. We all know that you stay ever busy on the road serving the nation’s needs on time. However, it is always been our duty to save many hardworking truckers across the nation to face any litigation with the Internal Revenue Service at least with their Heavy Vehicle Used Tax Form 2290. Continue reading

Truckdues.com wishes everyone a Happy Easter 2018 in Advance!

Easter is a time that, for many of us, has long been associated with gift-giving, chocolate-eating, and most importantly, spending time with family and friends. Since its origins, the global holiday, which celebrates the death and resurrection of Christ, has been a time of celebration, feasting, and many traditional Easter games and customs.

Easter is a time that, for many of us, has long been associated with gift-giving, chocolate-eating, and most importantly, spending time with family and friends. Since its origins, the global holiday, which celebrates the death and resurrection of Christ, has been a time of celebration, feasting, and many traditional Easter games and customs.

Here’s few tips for families to celebrate and participate in public events during Easter 2018: Continue reading

Your Pro-rated HVUT Form 2290 is due in 4 days. E-File soon!

Federal law states that HVUT Form 2290 is due on a vehicle by the last day of the month following the month of its first use. On that basis the Form 2290 is due now by March 31st, 2018 for vehicles first used since February 2018. Continue reading

Federal law states that HVUT Form 2290 is due on a vehicle by the last day of the month following the month of its first use. On that basis the Form 2290 is due now by March 31st, 2018 for vehicles first used since February 2018. Continue reading

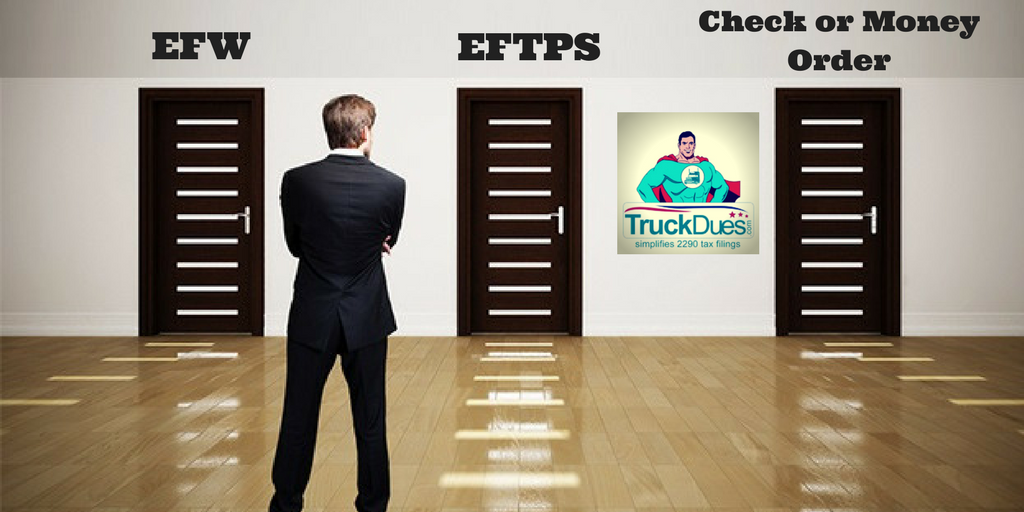

IRS Tax Payment Options available to pay HVUT Form 2290

When it comes to E-Filing your IRS Form 2290 through an authorized E-File provider such as Truckdues.com, there are 3 different payment options. Taxpayers can pay by Electronic Funds Withdrawal, EFTPS, Check, or Money Order. The options to pay by check or money order may be easier to understand, but the options for Electronic Funds Withdrawal and EFTPS may need an additional explanation. Continue reading

Just 10 more days left to E-File your Pro-rated HVUT Form 2290

Hello there truckers, we hope you are now reading this article with high spirits. Yet no wonder this is again a reminder on the nearest Form 2290 deadline, where March 31st, 2018 will be the due date to E-File your HVUT Form 2290 for vehicles first used since February 2018. Continue reading

Hello there truckers, we hope you are now reading this article with high spirits. Yet no wonder this is again a reminder on the nearest Form 2290 deadline, where March 31st, 2018 will be the due date to E-File your HVUT Form 2290 for vehicles first used since February 2018. Continue reading

Need to Report an Increase in the gross weight for your truck? Here’s how!

Hello there truckers, we hope you are reading this article at high spirits. Well, over this article we are going to discuss on a common question that arises for a Trucker, That how do I report a change on the vehicle gross weight. Perhaps we claim that is even simpler than you can ever imagine. Continue reading

Don’t panic when you’re truck exceeds exemption miles. Here’s what you need to do!

Hey there Truckers, in this article we are going to discuss what you need to do when your truck exceeds the exemption limits. Wanted to know more briefly, here it is… Generally Form 2290 is a Federal Tax Paid to the Internal Revenue Service (U.S. Department of Treasury) which is annually due. This tax is basically pro-rated and the taxes are paid up front. Continue reading

Hey there Truckers, in this article we are going to discuss what you need to do when your truck exceeds the exemption limits. Wanted to know more briefly, here it is… Generally Form 2290 is a Federal Tax Paid to the Internal Revenue Service (U.S. Department of Treasury) which is annually due. This tax is basically pro-rated and the taxes are paid up front. Continue reading

Just A Day left behind until your Pro-Rated Form 2290 deadline

Hello there truckers, this article is to remind you all that your Pro-rated HVUT Form 2290 is due by Feb 28, 2018 for the period beginning January 2018 through June 2018. As you are pretty aware of the fact Form 2290 is generally due by June and its payable until the end of August. Else, federal law states that Form 2290 must be filed on a vehicle by the last day of the month following the month of its first use. Continue reading

Hello there truckers, this article is to remind you all that your Pro-rated HVUT Form 2290 is due by Feb 28, 2018 for the period beginning January 2018 through June 2018. As you are pretty aware of the fact Form 2290 is generally due by June and its payable until the end of August. Else, federal law states that Form 2290 must be filed on a vehicle by the last day of the month following the month of its first use. Continue reading

Things you need to know beforehand about Form 2290!

What is a Form 2290?

Form 2290 is the form that is been used to File & Pay the Heavy Highway vehicle Used tax also abbreviated to be HVUT which is a federal tax that is due annually and payments are made to the U.S. Department of Treasury. However, on this matter the Internal Revenue Service represents the show as they are solely responsible for the entire governance of this tax.

Who Must File?

Well when we call it a Heavy Highway Vehicle Used tax, it clearly states these taxes are only concerned with Heavy vehicle which must comprise a minimum total gross weight of 55000 lbs i.e., (The weight of the tractor+ weight of the Loaded Trailer) and the same has been used over the public highway for multiple purposes such as Commercial Hauling, Agricultural, logging & so on. However, the IRS has drafted guidelines to differentiate the tax dues amongst the nature of duty that each heavy vehicle performs.

When is the Form 2290 Due?

Federal law states that Form 2290 must be filed on a vehicle by the last day of the month following the month of its first use. Else, these taxes are generally due by June and its payable until the end of August of every year.

How much is the Tax amount by the way?

The Tax due varies upon the gross weight of a desired Vehicles and the distance traveled within a respective HVUT tax period. Below 55,000 pounds do not have HVUT because they do not qualify as a heavy vehicle. Vehicles between 55,000 and 75,000 pounds owe $100, plus $22 per 1,000 pounds over 55,000 pounds. Finally, for vehicles that are over 75,000 pounds the maximum HVUT is $550 per year.

Who is Exempt from HVUT?

Although it is rare, some Vehicles that fit the above description may be exempt from the HVUT and Filing requirements of HVUT Form 2290. To officially be exempt from filing Form 2290, the vehicle must be owned and operated by the following:

- The Federal Government

- The District of Columbia

- State or local government

- American National Red Cross

- Non-Profit Volunteer Fire Department, Ambulance Association, or Rescue Squad

- Qualified Blood Collector Vehicles

- Mobile Machinery that meets specifications for a chassis

- Indian Tribe Government (Only if the Vehicle is Used for essential Tribe or Government Function)

- Mass Transportation Authority (Only if granted certain powers normally exercised by the state)

Reach us back for any further assistance over the following mediums:

Phone: (347) 515-2290 [Monday through Friday, 9 A.M to 5 P.M, Central Standard Time]

E-mail: support@truckdues.com

Live chat with our tax representatives.

Have a Good One! See you over the next article.